Photo: Outokumpu Corporation

The green transition is one of the primary drivers of industrial transformation in the 21st century. In 2023, the steel industry, both carbon and stainless, reached a market value of USD 928 billion, producing ~2 billion tons of steel. Currently, the steel industry accounts for 10% of global greenhouse gas emissions – yet our society will require significant amounts of energy and steel also in the future. By 2050, steel industry emissions need to be reduced by 90% compared to 2022 levels, a monumental change that requires a deep transformation of steel actors from around the world.

Text & images by Outokumpu

Outokumpu, a global leader in sustainable stainless steel, has published a report* on the future of steel – identifying five critical shifts to accelerate the green transition and the needed industrial transformation. The report builds a clear view on how the steel industry needs to evolve, encompassing the growing need to decarbonize and go beyond carbon, the significance of a stable and long-term regulatory environment, the need to move up the circularity value chain, the shared responsibility of the green investments – and the necessity for a repositioning of the green transition to gain public support.

“Steel and other resources are critical as nations tackle industrial resilience and the green transition. While today’s focus is on reducing carbon emissions, future challenges will require a broader approach, addressing environmental limits and social responsibilities. Recognizing where an organization stands in this transformation is key to driving change that goes beyond better materials or lower emissions. Success will come to those who embrace bold, forward-thinking strategies,” says Johann Steiner, Executive Vice President for Sustainability, Strategy, and People at Outokumpu.

* Outokumpu commissioned the research that was conducted by a Swedish consultancy Kairos Future, between June-September 2024, utilizing a blend of desk research, AI, data analysis, and C-level interviews across the steel industry value chain. The report has focused primarily on EU/USA markets.

Shared responsibility

For some of the shifts identified, early progress has been promising as industry forerunners are taking steps towards decarbonisation and increasing circularity. Steel is an industry closest to circularity with nearly 85% of end-of-life steel being collected for recycling globally – though with only 30% of it used to produce new steel, there is still room for improvement. Arguably, much remains to be done to transform the industry and to turn the green transition into a new competitive advantage ensuring green growth. New threats are also looming on the horizon, not least with rising geopolitical challenges. According to the report, ambitious, long-term policies and government support are needed to accelerate the green transition. To gather public interest and support, the report also calls for a rebrand of the green transition to make it more tangible and visible to the public in the form of a more everlastfs-hp-turbulent-times-for-the-aerospace-industry-1ing way of consuming.

“Virtually everything we humans do today has a compounding impact on the physical world. Our challenge for the 21st century is drastically reducing that impact – which requires a fundamental transformation in how we produce and consume. It is clear that carbon steel and stainless steel will have a central role to play in that transition, both as a material and as a defining aesthetic feature of a society that needs to build products designed for longevity”, says Olivier Rostang, lead researcher for the white paper at Kairos Future.

“Outokumpu has rightly highlighted that cooperation and immediate action are essential to speed up the global net zero steel transition. Getting the industry to net zero is one of the critical challenges of our time. We can achieve this. But we’ll only drive sector transformation, fast, if we have effective collaboration and action from all parts of the value chain – not just steel users, but steelmakers, policymakers, and investors alike”, says Jen Carson, Head of Industry at Climate Group.

The report, entitled 5 shifts shaping the steel industry, runs to 65 pages. Fortunately, an executive summary is available which encapsulates key findings such as highlights from the five critical shifts, as follows.

Shift 1: From carbon reduction to sustainability expansion

Sustainability scopes are expected to continue growing in the long-term, our earth system depends on it. While carbon has been the primary focus, biodiversity, water, and social cohesion are likely to emerge as the next major areas of interest and innovation. The steel industry must recognize that the definition of sustainability is constantly expanding and adapt accordingly.

Key future questions:

- How does your organisation leverage decarbonization innovations to also benefit other environmental aspects?

- How can your organization finance Its green transition and what will be the cost if you do not?

- What kind of pricing mechanisms and regulations do you need to accelerate sustainability?

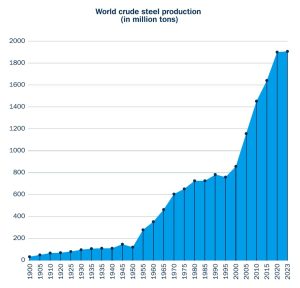

World crude steel production

In 2023, the steel industry reached a market value of USD 928 billion, producing nearly 2 billion tons of steel. Over the past few decades, this sector has experienced significant transformations: new players have entered the global stage, and both economic and environmental challenges have intensified. At the same time, there is a global focus on developing innovative approaches to decarbonize production processes.

In 2023, the steel industry reached a market value of USD 928 billion, producing nearly 2 billion tons of steel. Over the past few decades, this sector has experienced significant transformations: new players have entered the global stage, and both economic and environmental challenges have intensified. At the same time, there is a global focus on developing innovative approaches to decarbonize production processes.

Recycling rates for steel are high, and in some industrialized countries, the rates come close to 98%. On the other hand, the amount of recycled steel only constitutes about 30% of the input for new steel production. Still, these are recycling rates significantly beyond what other industries could currently even dream of. Photo: Outokumpu Corporation

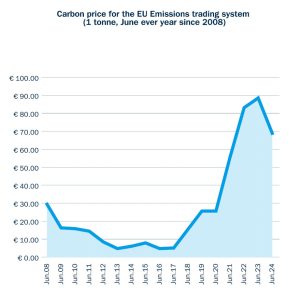

Putting a price on carbon

Economists at the London School of Economics argue that carbon pricing is the most efficient way of decarbonizing the economy. Not only does it lead to more efficient behavior in consumers and industry, it also provides a way to fund the transition. Many governments have implemented schemes to put a price on carbon emissions, such as emissions trading systems (ETS). The European Union currently has the most advanced system, where the price of emitting a ton of carbon has increased almost tenfold in 5 years. China, California, Canada, all have carbon pricing systems as well, albeit significantly less encompassing.

Economists at the London School of Economics argue that carbon pricing is the most efficient way of decarbonizing the economy. Not only does it lead to more efficient behavior in consumers and industry, it also provides a way to fund the transition. Many governments have implemented schemes to put a price on carbon emissions, such as emissions trading systems (ETS). The European Union currently has the most advanced system, where the price of emitting a ton of carbon has increased almost tenfold in 5 years. China, California, Canada, all have carbon pricing systems as well, albeit significantly less encompassing.

Shift 2: From geopolitics to policy

Despite the uncertainty in the world and concerns about the future of globalisation, maintaining a stable regulatory environment is crucial for the industry’s success. Policymakers should prioritise long-term stability over short-term political wins and forget the importance of industrial sustainability transformation policy at home when the focus on geopolitics is high.

Key future questions:

- Considering your organization’s current supply chains and the potential division of the global value chain into regional blocks, which specific regions or countries are likely to become increasingly critical for your operations? What proactive steps can you take to strengthen your presence and partnerships in these regions to ensure long-term resilience and competitiveness?

- As the energy transition reshapes global power dynamics, what specific risks and opportunities does it present for your organization?

- How can your organisation contribute to making the green transition more visible, exciting, and appealing to the public? What innovative education and engagement strategies can you employ to build broader enthusiasm?

- How can you turn the green transition into a new competitive advantage and ensure green growth?

Shift 3: From circular leader to circular enabler

Steel holds the distinction of being both the world’s most recyclable and most recycled material, placing the industry at the forefront of the circular economy.

To continue leading by example, steel companies must advance along the circularity value chain, surpassing basic recycling practices and investing in circular innovations. This approach will safeguard the positive demand for steel products in the face of competition from alternative materials

Key future questions:

- What does it mean for our bottom line to be a leading circular industry?

- What is the next frontier in circularity and circular business models for the industry? Who is leading?

- How can new value propositions be created that move up the circularity value chain?

Shift 4: From shaming players to changing the game

The green transition comes at a price, and as with most investments, it carries high initial costs. The costs should be shared among stakeholders, with governments playing a vital role

in ensuring long-term support. By internalizing externalities, guaranteeing demand, and supporting innovative ventures, we can overcome the green premium trap and accelerate the transition to a pragmatic, sustainable economy – shifting the game from one of guilt and sacrifice to one of aligned incentives and long-term prosperity.

Key future questions:

- How can you redesign your business model to align incentives with sustainable practices and overcome the green premium trap?

- What role can your organization play in advocating for policies and regulations that internalize environmental and social externalities?

- How can you tap into government spending and procurement to drive demand for your sustainable offerings?

- How can you more efficiently convey the use of sustainable but invisible materials to citizens?

Shift 5: From “Made in EU/USA” to “Made to Last”

To gather public interest, the green transition needs an aesthetic rebrand, shifting from “green” to “everlasting”. The transition must be tangible and visible to the public. Industrial leaders, in collaboration with design and cultural leaders, should define the main features of this everlasting era. This new branding should go beyond traditional labels like “made in Europe or “made in USA”, and instead emphasize “made to last”, highlighting the enduring nature of sustainable products and practices. The transformation must make the invisible visible.

Key future questions:

- How can you make the sustainable transition more tangible and emotionally resonant for your customers and stakeholders?

- What role can aesthetics play in signalling your commitment to sustainability and shaping the everlasting era?

- How can you collaborate with upstream and downstream partners to lead the charge in making the sustainable transition visible and desirable?

About this Featured Story

Appearing in the May 2025 issue of Stainless Steel World Magazine, this Featured Story is just one of many insightful articles we publish. Subscribe today to receive 10 issues a year, available monthly in print and digital formats. – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.