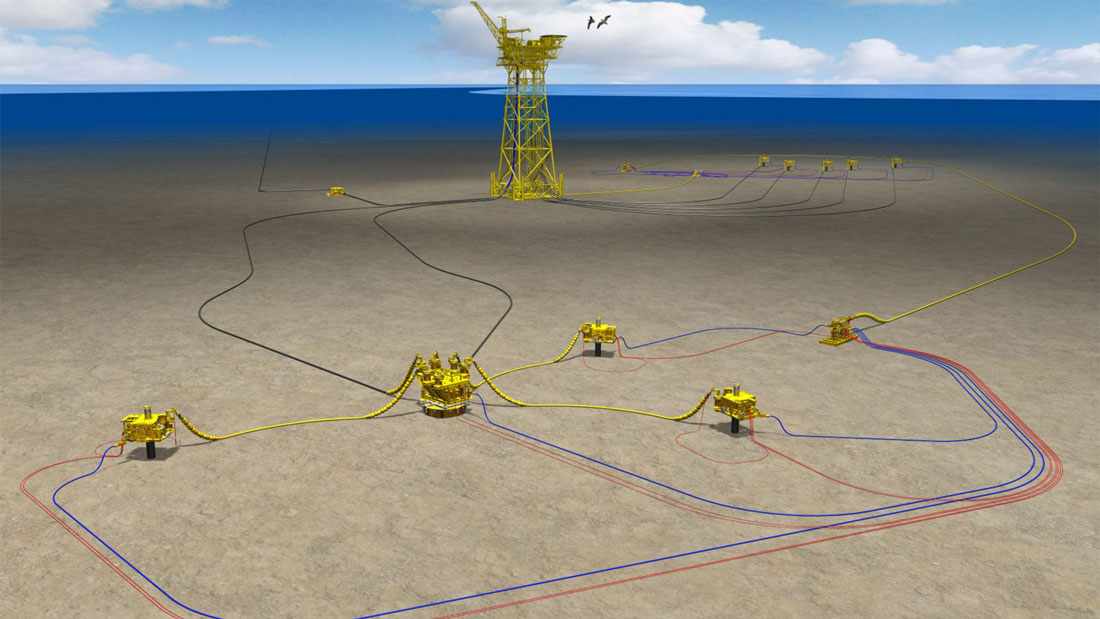

(FPSO) Espirito Santo, Parque das Conchas field, Brazil. Heavy oil, BC-10 field offshore Brazil deepwater project.

Three fields are being developed with subsea wells and manifolds, each field is tied back to the centrally located FPSO. © Roberto Rosa.

The offshore oil & gas sector is faced with several hard choices: chief among these is how to meet higher demand without exceeding emission reduction targets and how to manage the transition to renewables. Stainless steel and special metals play a central role in both old and new energy types.

By James Chater

Fuel scarcity

For those of us who lived through the 1970s, it feels like déjà vu all over again. Inflation, economic malaise, East-West tensions, energy shortages…the relatively benign global economy of the last 30 years has given way to an altogether bleaker outlook.

The problems started well before the Russian invasion of Ukraine. As the Covid menace receded, release of pent-up demand caused the price of oil, gas and other primary materials to soar, a trend that was intensified by the war. Moreover, President Biden had already curbed investment in fossil fuels and vowed to end subsidies. As a result of all these pressures, Americans now have to pay 50% more to fill their tanks than this time last year. Meanwhile, Europeans are trying to wean themselves off Russian imports.

At the same time, Germany fears that a reduction or cessation of oil and gas imports from Russia could cripple its industry. In any case, Russia is resisting sanctions by selling more oil and gas to China and India.

Everywhere, the post-Covid surge, in combination with the war, has caused a 1970s-style rise in energy prices, depressing the economy and causing inflation. (As I write, the price of oil and gas has receded after spiking, but further rises seem likely.) Renewable energy investment has been growing fast but has not yet reached the point where it can replace the missing fossil fuels.

Oil & gas by region

Russia

There has been a spate of disinvestment in Russian oil & gas, including LNG. BP, Shell, ExxonMobil and Equinor are among the companies withdrawing from future investments. Meanwhile, Germany has paused the Nord Stream 2 gas pipeline, and gas technology specialist Linde has suspended collaboration on new projects. Although these withdrawals seem not to have made much of an impact so far, in the long term, Russia’s lack of access to foreign technology is likely to hinder its operations. The decline of Russian oil and gas in the European market is bullish for producers elsewhere, and there are signs that these other regions – North America, Africa and the Middle East – are stepping up production to meet the shortfall.

North America

Several offshore projects are taking shape in the US Gulf of Mexico. In September 2021, BP started up its Thunderhorse South Expansion Phase 2 project. In July 2021, Shell announced Whale, its second deepwater development in the GoM. Co-owned by Chevron, Whale is scheduled to start production in 2024. It will feature a semi-submersible production host in more than 8,600 feet of water with 15 oil-producing wells.

Chevron and TotalEnergies have announced the Ballymore project, a tie-back to the Blind FPU. First oil is expected in 2025. Beacon Offshore Energy has awarded Subsea 7 the contract for four subsea wells for the Shenandoah Development.

As for shale, after a time of consolidation and limited investment, production rose earlier this year in response to a surge in demand that preceded the war in Ukraine. This has been largely achieved through “re-fracs”, i.e. revisiting existing wells to give them a second, high-pressure blast, a less expensive option than finishing a new well. Exxon and Chevron are among the companies that have announced a boost in production in the Permian basin in Texas. The Canadian oil sands sector has likewise seen a boost in production and investment in the wake of higher prices and expansion in export capacity in the form of pipelines to the USA.

Africa

In Angola, BP and Eni are merging their activities in a new company, Azule. New projects include the new Agogo and PAJ oil projects. It will also develop the New Gas Consortium (NGC), the first non-associated gas project in the country. Eni has also signed an agreement with Algeria’s Sonatrach to develop gas fields and decarbonization via green hydrogen, and one to allow Eni to increase the quantities of gas imported through the pipeline connecting Algeria to Italy. Eni has also signed agreements in Egypt and the Republic of Congo to boost gas production.

South America

The South American region is also growing significantly. There have been several discoveries offshore Guyana, where ExxonMobil is developing four projects in the Stabroek Block. In 2022 the Libra Consortium (Petrobras, Shell, TotalEnergies, CNPC and CNOOC) launched phase 4 of the giant Mero pre-salt project in the Libra Block, and started production at the Mero field phase 1 from the FPSO Guanabara. Petrobras is seeking to install a high-pressure separation unit to reinject CO2-bearing gas into the field. The Atlanta field in the Santos Basin is also to acquire an FPSO from Yinson Holdings.

Middle East

Production is also likely to rise in the Middle East, where Saudi Aramco has announced a production boost, having awarded offshore contracts worth more than USD 1.6 billion.

Australia

In Australia, where many natural gas projects have come online recently, more fields are being developed, notably two off the coast of Western Australia. Last November, Woodside and BHP made the final investment decision for the Scarborough gas field, which will consist of new offshore facilities connected to the Pluto LNG onshore facility, where a second train will be added. The first cargo is expected in 2026. Saipem will build a trunkline, while the subsea pipelines and production systems have been confided to Subsea 7. The Shell-SGH partnership has approved the development of the Crux gas field off Western Australia, which will be connected via a pipeline to the Prelude FLNG. First gas is expected in 2027.

Recent stainless steel orders

■ Butting has delivered 100km of longitudinally welded duplex pipes for a project in the Arabian peninsular. The grade was UNS S31803/UNS S32205/1.4462, which offers advantages with regard to pitting corrosion, stress corrosion cracking and vibration corrosion cracking.

■ For the Mero and Buzios oil fields in the pre-salt Santos Basin off Brazil, umbilical tubing made of SAF 2507® was ordered from Alleima (formerly known as Sandvik Materials Technolog)y. The choice of super duplex stainless steel was determined by the high pressures due to a water depth of around 2,000 metres.

■ Butting received an award for its GluBi® mechanical clad pipes which were reel-laid by Subsea 7 in the Hod oil field in the Norwegian North Sea. The GluBi® pipe features an additional special adhesive between the carbon-manganese steel and the corrosion-resistant liner. The same company supplied 7,400 metres of mechanically clad pipes for an LNG project in Qatar.

North Sea

The Norwegian North Sea continues to be active in terms of exploration and development. Equinor and partners are developing gas condensate discoveries next to the Åsgard field. For Åsgard itself, Equinor has awarded MAN a contract for a subsea compressor unit and is upgrading others.

Aker Solutions is developing the Valhall field and the King Lear discovery. The projects include a new central platform and an unmanned wellhead platform which will act as a central hub, adding wells, production and processing capacity and replacing existing infrastructure. Equinor is also developing the Smørbukk Nord field with TechnipFMC. ConocoPhillips has submitted to the Norwegian authorities a plan to develop the Tommeliten A, which straddles the border between the UK and Norwegian sectors of the North Sea. The project will include a subsea production system with ten production wells and an electrically heated flowline, and a new processing module. First production is expected in 2024.

Sustainability

How are the oil & gas companies faring when it comes to sustainability? Some argue there should no development of new fields at all. Denmark, New Zealand and France have all announced bans on new oil and gas licensing. Ireland has outlawed future exploration and production while honouring existing licences. Most companies are pursuing a middle course, reducing emissions and energy output on their existing and new projects. Measures include elimination of flaring, CO2 re-injection, CCS, green hydrogen manufacture, biofuels, using solar, wind energy or hydro as energy input for an oil or gas field, or various technologies to reduce methane and carbon emissions. Many companies have produced an “energy transition plan” outlining in detail the steps they are taking to achieve 50% emissions reduction by 2030 and net zero by 2050.

Wind power

In addition, many European oil & gas majors – Equinor, Shell, BP, Total, Eni – are investing directly in renewable energies, especially solar and wind. Offshore wind is an obvious way for oil and gas companies to leverage their experience of operating in the high seas. This energy type is growing faster than onshore wind power and is spreading from Europe to Japan, the United States and elsewhere. Apart from conventional wind farms consisting of towers attached to the seabed, floating wind farms are being pioneered. These would permit wind farms in deeper water. However, they are expensive and need to be scaled up and standardized to achieve commerciality. This effort is being driven by Equinor, which is planning a large-scale commercial floating wind farm off the coast of Scotland 30 times larger than its Hywind Scotland project. It is teaming up with Technip Energies to produce steel semi-substructures with a simplified, more robust design.

Did you know?

■ The 24 Hours of Le Mans racing rally (11-12 June 2022) used 100% biofuel supplied by TotalEnergies.

■ In 2021, 144 billion cubic metres (bcm) of gas was flared at upstream oil and gas facilities, the equivalent of nearly 400 million tonnes of carbon dioxide (CO2) (1).

■ The EU’s sustainable finance strategy includes a “green taxonomy” which classes certain energy sources as green. This taxonomy has sparked a controversy as the EU has decided to include natural gas and nuclear as “green” energy types. Mr Putin must be rubbing his hands with glee.

Reference

1. GGFR, cited at : https://valve-world.net/routine-flaring-net-zero-in-2030/

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.