The stainless steel sector accounted for over 70% of nickel usage in 2021; however, demand for electric vehicle batteries surpassed 11% market share in 2021.

By Ricardo Ferreira, INSG Director of Market Research and Statistics & Francisco Pinto, INSG Manager of Statistical Analysis

Government and industry representatives met online on the 22nd and 25th April 2022 for the International Nickel Study Group meetings which reviewed forecasts for nickel production and use for 2022. This article gives a brief overview of recent developments and is based on the data finalised at the meetings.

At the beginning of 2022, the economies of most countries in the world were rebounding from the COVID-19 pandemic and grappling with the additional issues of energy problems, logistics bottlenecks and rising inflation. These factors were having a notable impact on both metal production and usage. The conflict in Ukraine, followed by economic sanctions on Russia, further increased energy problems, especially in Europe, pushed inflation even higher and added uncertainty. In China, COVID outbreaks in some areas led the government to impose lockdowns. Consequently, recent forecasts for world growth were revised down.

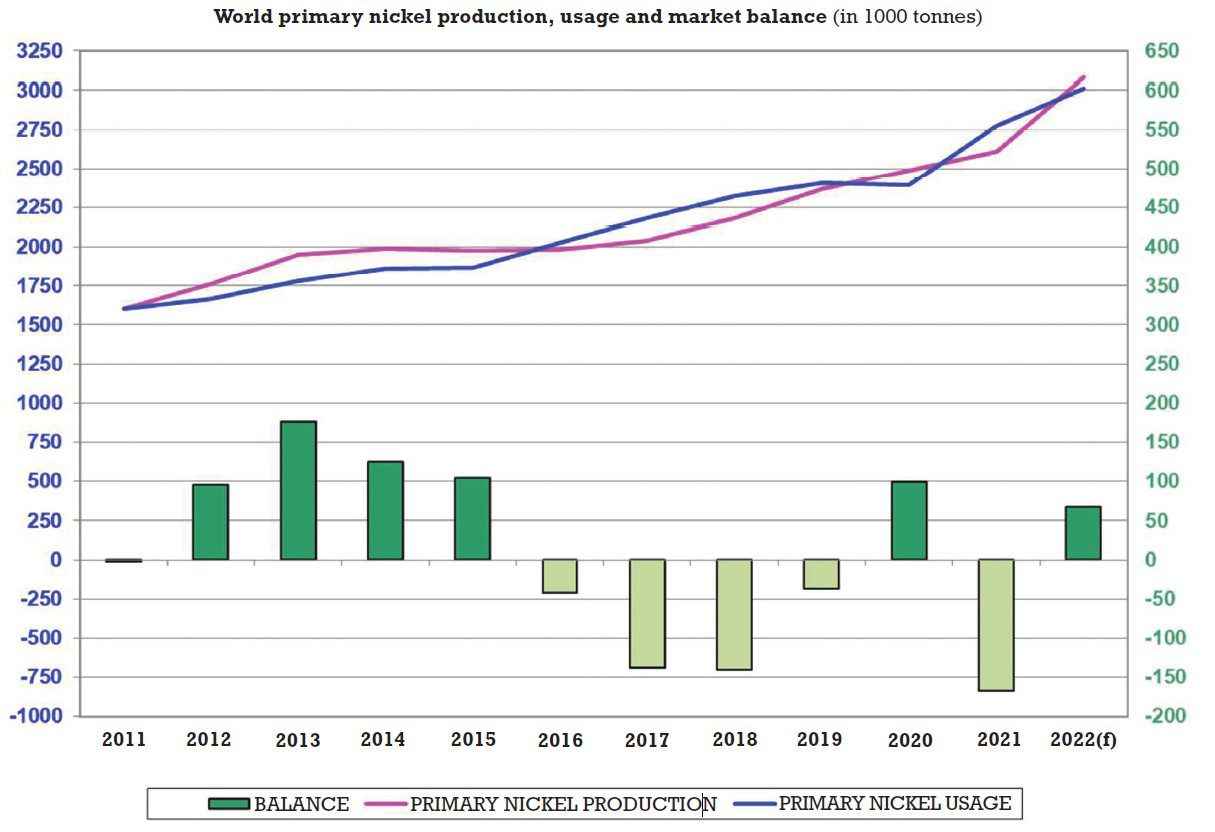

INSG reviewed its forecast for the nickel market balance for 2022 to a surplus of 67.2 thousand tonnes (kt) during its April 2022 meetings. Primary nickel production in 2022 is expected to reach 3.082 million tonnes (Mt) while usage is forecast at 3.015 Mt. Revised figures for 2021 indicate a bigger deficit than previously envisaged of 168 kt with production rising to 2.608 Mt and usage reaching 2.776 Mt.

Primary nickel production

In 2022, world primary nickel production is expected to grow by +18%, after increasing +4.8% in 2021. Increases in output have been influenced mainly by Indonesia. However, China will again expand production, after decreases in 2020 and 2021. In the following paragraphs, we will comment on nickel production from the perspective of the type of nickel product: class I, nickel pig iron (NPI), mixed hydroxide precipitate (MHP), nickel matte and nickel sulphate. Class I nickel, or refined nickel, is broadly defined as product with a nickel content of 99% or more, including electrolytic nickel (whole and cut cathodes), pellets, briquettes, granules, rondelles and powder/flakes. This class of product has recently received media attention due to the potential influence of the conflict in Ukraine on production levels of Russian-owned facilities. In 2021, world class I nickel production is estimated at below 770 kt, with Nornickel reporting a level of 168.3 kt of saleable metal production from Kola in Russia (refined nickel from own Russian feed) and Harjavalta in Finland (from own Russian feed and 3rd party feed). For 2022, an expansion in world production of 50 kt to 70 kt is possible as a consequence of increases in a number of countries. Class II nickel, or charge nickel, is usually defined as having less than 99% nickel content, and comprises ferronickel, nickel oxides/oxide sinter and utility. NPI can be considered as a non-standard ferronickel (typically with lower grade). INSG estimates around 1.7 Mt of class II nickel production in 2021, with combined Chinese and Indonesian NPI accounting for almost 1.29 Mt (close to 50% of world primary nickel production). For 2022, class II nickel output is forecast to rise by a further 300 kt of contained nickel. The major part of this increase will be NPI from Indonesia.

MHP and nickel matte are two intermediate nickel products, meaning that both will still be further processed within the nickel industry. These two types of products have gained relevance in recent years because they are increasingly being used to produce nickel sulphate for electric vehicle (EV) batteries, especially the material produced in Indonesia. Currently, the most advanced Indonesian high-pressure acid leaching (HPAL) projects regarding MHP output are: PT Halmahera ( Phase 1: 37 kt; Phase 2: 18 kt), PT Huaqai (30 kt + 30 kt) and PT QMB New Energy (50 kt). PT Halmahera started trial production in April 2021, and PT Huaqai did the same by the end of the year. PT QMB New Energy is scheduled to be commissioned in 2022H2. These products will be exported to China to be processed.

Regarding nickel matte, there are 3 projects in Indonesia at the moment converting NPI into this product: Tsingshan (75 kt), Huake Nickel (45 kt) and Zhongqing New Energy (Phase 1: 30 kt). The first two started at the end of 2021 and the latter is scheduled to be commissioned by 2022-Q3. This production will also be exported to China to be processed to produce car batteries.

Primary by region

Asian primary nickel production is forecast to increase by +22% in 2022, to reach 2.185 Mt, with Indonesia raising output to 1.2 Mt, consolidating its position as world leader, followed by China with 750 kt.

In Africa, primary nickel production is expected to increase by +16% in 2022. After restarting production in March 2021, the Ambatovy refinery in Madagascar is projected to ramp up. South Africa confirmed a recovery to 2019 production levels in 2021 with output there predicted to expand further in 2022. Thakadu Battery Materials in South Africa commissioned its battery-grade nickel sulphate refinery in March 2021; the plant has an annual capacity of 30 kt and is planning to produce 16 kt this year. Thakadu will refine crude nickel sulphate supplied by Sibanye-Stillwater and other sources. On the mining side, CMB in Ivory Coast and Munali mine (CNM) in Zambia restarted production in 2018 and 2019, respectively. Both CMB and CNM are exporting ore to China, and the former has also been shipping to Cyprus (to feed the new nickel sulphate project), and to North Macedonia.

The Americas are forecast to have a growth of almost +10% of primary nickel production in 2022. Vale is expected to increase production in Canada to pre-pandemic levels and to marginally raise output at Onça Puma, Brazil. In 2020, Brazilian Atlantic Nickel’s Santa Rita mine, owned by Appian Capital, restarted production, however, the planned sale of the operation to South-African Sibanye-Stillwater was cancelled. In Colombia, South32 reported a higher production guidance for the Cerro Matoso plant for 2022. In Cuba, a rise in production in 2022 is planned.

In Europe, production declined in 2021, affected by the flooding at Nornickel’s 2 mines at the beginning of the year, which resulted in reduced output in both the Russian Federation and Finland, where output is forecast to increase by 5% in 2022, due to the recovery at Harjavalta and to the ramp up of Terrafame’s Battery Chemicals plant, commissioned in June 2021, which will produce nickel sulphate to supply to EV batteries. Larco in Greece continues its efforts to privatize its ferronickel plant. In France, Sibanye-Stillwater purchased the Sandouville nickel hydrometallurgical processing facility from Eramet. In Cyprus, Hellenic Minerals announced that the Skouriotissa plant, with a capacity of 10 kt of nickel sulphate, was completed last August.

In Oceania, primary nickel production is expected to recover in 2022 to close to pre-pandemic levels in both Australia and in New Caledonia (France).

As mentioned in the previous INSG article published in this magazine, in terms of new projects in Australia, First Quantum restarted the Ravensthorpe plant in 2020-Q2 and is currently ramping up (though at a lower level than anticipated). Last October, BHP reported it has produced the first nickel sulphate crystals from its nickel sulphate plant in Kwinana, South of Perth, and Panoramic announced the restart of processing operations at Savannah to produce nickel-copper-cobalt concentrates.

Primary nickel usage

World nickel usage has grown steadily since 2009, with the only exception being 2020, when it declined by -0.6%. In 2021, usage rebounded strongly with a rise of +16.1% and is forecast to increase by a further +8.6% in 2022, to reach 3,015 Mt. Most world regions will experience growth in 2022, although in tonnage terms the majority of the increase will be in Asia, most notably China.

In 2021, Asia accounted for 83.5% of global primary nickel usage, reinforcing its dominant position (as a reference, Asia’s share in 2010 was “only” 63%). Further growth of more than +9% is anticipated in the region in 2022. Demand in China, which used 55.5% of the world’s primary nickel in 2021, is forecast to increase by more than +10%. After starting production of stainless steel in 2017, Indonesia became the second most important nickel user in 2020 (with usage reaching 210 kt, surpassing that of Japan) and achieved more than 380 kt in 2021. Usage is projected to increase by a further +12% in 2022.

Nickel usage in Europe increased by almost +10% in 2021, but is anticipated to grow at less than +3% in 2022. In Africa, demand declined by -14% in 2021 and is forecast to decrease by just under a further -3% in 2022. In the Americas, usage increased by less than +1% in 2021, but is projected to expand by over +8% in 2022, supported by a good outlook in the United States.

The stainless steel sector is the most important first-use market for nickel, accounting for more than 70% of nickel usage in 2021. However, the proportion of demand this sector accounts for declined when compared to 2020. It is projected to continue a slow decline because of increasing demand for batteries for electric vehicles, which is estimated to have surpassed an 11% share of the market in 2021. The growing electrification of vehicles will surely result in higher demand for nickel in order to produce the required number of lithium batteries and it is likely that the proportion of the market accounted for by this sector will increase significantly over the coming years.

The International Stainless Steel Forum (ISSF) released production figures for the full year of 2021 showing that “stainless steel melt shop production increased by 10.6% year-on-year to 56.3 million metric tons”, after decreasing by 2.5% in 2020. Preliminary forecast figures for world stainless steel consumption (subject to revisions) indicate an increase of +3% to +4% in 2022. These figures confirm that demand growth from the stainless steel sector was robust in 2021, but is expected to be more modest in 2022, in line with the recovery in 2021 and lower economic expectations for 2022. As reported by EV Volumes, world sales of EVs reached 6.75 million in 2021 (+108% growth), after increasing +9% in 2019 and +42% in 2020. EV sales represented 8.3% of global light vehicle sales in 2021, while in 2019 the share was 2.5% and in 2020 it was 4.2%. In 2022-Q1, EV sales were almost 2 million units, with over 851 thousand in March alone (a +60% rise compared to the same period of 2021), representing a market share of 15%. Nevertheless, it should be noted that nickel-free lithium-ion iron phosphate (LFP) batteries represented just under 50% of the market in 2021, with sales of this type of battery continuing to grow in 2022. In China, production of ternary precursors used to produce different types of nickel-containing batteries has been rising since February 2020, reaching almost 320 kt in

2020 and more than 633 kt in 2021, according to MySteel. China therefore accounted for over 2/3 of world production. In the first quarter of 2022, production increased by +45%. High-nickel NCM811 and NCM622 precursors have gained market share in 2021, representing 29% and 24%, respectively. NCM811 precursors accounted for almost 40% in 2022Q1.

Nickel prices and stocks

Lastly, we will briefly analyse nickel prices and exchange stocks for 2021 and the first months of 2022.

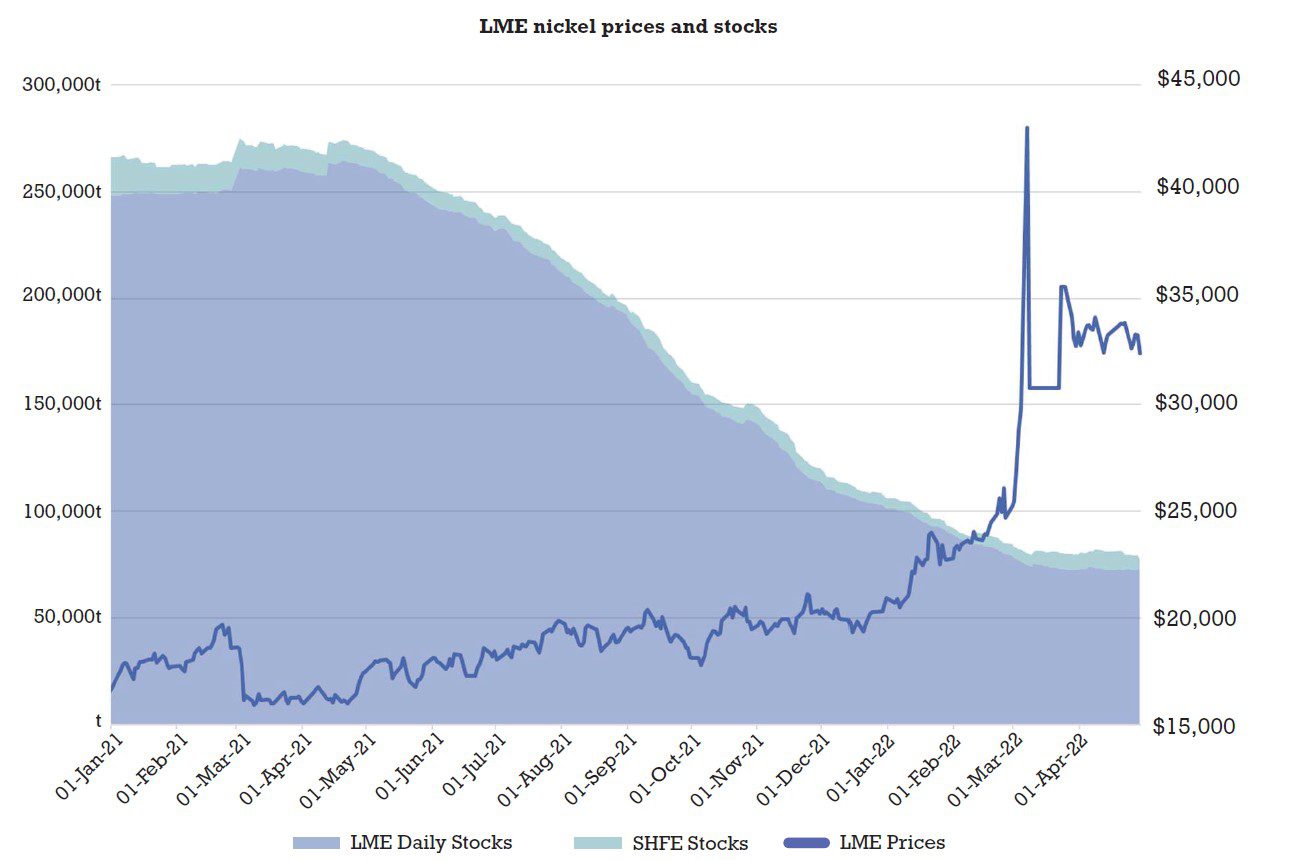

During 2021, the London Metal Exchange (LME) nickel price (close, cash settlement) rose by +25%, from 16,607 USD/t to 20,750 USD/t. The upward move was not constant though – there was a sharp drop at the end of the first quarter (from 19,568 USD/t in 25 February to 15,907 USD/t in 9 March), coinciding with Tsingshan’s announcement of NPI to Matte conversion; and another one in mid-September to early October (20,375 USD/t in 10 September to 17,800 USD/t in 5 October), probably influenced by the news of Evergrande’s credit issues. From the end-October until the end of the year, prices rebounded to levels in a range between 19,000 and just under 21,000 USD/t.

Early in 2022, the nickel price started to increase more rapidly.

At this time, exchange inventory levels were relatively low, there were logistical bottlenecks resulting from the COVID-19 pandemic and a looming conflict between Russia and Ukraine was seen as having the potential to disrupt nickel trade flows. The first news on exchange “squeezes” started to appear in the third week of January.

At the end of February, at the time of the escalation of the Russian-Ukrainian conflict, a noticeable price surge took place, with nickel closing at 25,650 USD/t on 22 February, surpassing 25,000 USD/t for the first time since 2011. The price kept hitting new maxima – by 4 March, LME nickel closed at 28,700 USD/t and the next business day (7 March), there was a significant surge to 42,995 USD/t (the largest ever reported daily increase). During the next morning, prices continued to rise rapidly to an intraday peak above 100,000 USD/t resulting in the LME suspending nickel trading and cancelling trades, on the grounds that the “Nickel market [had] become disorderly” (LME Notice 22/052). News sources reported that the dramatic rise in prices was due to a short squeeze, triggered by a major player reportedly facing difficulties meeting margin requirements. Nickel trading was resumed on 16 March, with newly set price limit changes

(5% on 16th March, then 8% on the 17th, 12% on the 18th and 15% on the 21st). These limits led the clearing house to suspend nickel trading on 17, 18, 21, 23 and 24 March. The LME thus reported a price of 30,800 USD/t from 8 to 22 and 35,550 USD/t from 23 to 25 March. After this, the nickel price oscillated between 32,400 and just above 34,100 USD/t, ending April at 32,430 USD/t.

After hovering at over 270,000 t by April 2021, combined LME and Shanghai Futures Exchange (SHFE) stocks started to decline, arguably in response to surging demand from a booming Chinese EV industry in 2021 (although not all nickel removed from exchange reported stocks might have been consumed). Combined inventories decreased at an average pace of nearly 20,000 t per month from May 2021 until January 2022, dominated by LME drawdowns. From February, combined monthly stock declines slowed down significantly. In April, the LME stocks had their first increase (378 t) for a year, but the combined change was still negative at -1,683 t, due to a larger SHFE drawdown. By the end of April, the LME reported stocks of 72,768 t nickel, while the SHFE reported 5,354 t.

In February, the LME reported off-warrant stocks of 2,428 t, a low since the exchange first started to provide this figure in February 2020, and less than one-tenth of the all-time high reached a year before (44,058 t).

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.