Authored by James Chater

Market conditions

In many parts of the world, desalination is ceasing to be a luxury, it is becoming a necessity. Lack of drinking water is the no.1 factor adversely affecting health in areas without water security, and one in six people world-wide lack access to safe drinking water. Global warming is causing drought and melting ice caps, meaning that groundwater is fast disappearing. Particularly at risk are large parts of Asia, the United States (especially California) and parts of South America. Unpredictable weather patterns, in which floods and drought occur with greater frequency, make it difficult to predict demand for desalination.

Planning is further complicated by slow construction lead times, which involve lengthy consultation. Also, if an area has suffered drought and desalination plants are built, the risk is that the return of rain will make it look as though the project was a white elephant, at least in the short term. But in the long term, it is fair to assume that demand for desalination will increase sharply. Between 2008 and 2013 capacity jumped by 57%. Whether or not this expansion rate is sustained, technological progress, coupled with increasing demand from the burgeoning mega-cities of developing regions, point to busy times ahead for the desalination industry.

Projects

The ongoing drought in California has more or less forced the state to embrace desalination. Most of the upcoming Californian projects will probably be solar-powered, though this is not the case for the Carlsbad RO plant, the startup of which was brought forward from 2016 to 2015. The solar-powered plant at Fresno will not only remove salt and metals from the water but recycle them for use in other products. Desalination units will also come to Santa Barbara and Huntington. All in all, between 13 and 15 plants have been proposed for the Sunshine State. In the North Africa and Middle East region the need for desalination is overwhelmingly obvious.

Many of the region’s recent projects are notable for their size. In fact, “the world’s largest” is an oft-used, but not always accurate, epithet associated with these projects. In 2005 Ashkelon was the largest SWRO plant, but it was soon overtaken. Fast forward to 2018, and we find that a desalination plant being built at Rabigh, Saudi Arabia, will be almost triple the capacity of Ashkelon. More important than sheer size, though, are the technical advances made possibly by applying economies of scale. At Sorek, for example, the pressure tubes will expand form 8 in. to 16 in., reducing the piping requirement by 75%. Advanced energy recovery techniques have been applied at Hadera and in later projects.

The building will continue: Morocco has completed a pilot mobile plant fuelled by solar power. The Red Sea to Dead Sea (RSDS) desalination project, which aims to provide water to Israel, Jordan and Palestine, has been signed in Aqaba. Qatar is boosting its capacity in preparation for the 2022 World Cup. Egypt is planning projects in Hurghada, East Port Said and on the Suez Canal. The UAE is building a plant at Ghalilah in Ras Al Khaimah and is planning others. Other installations are planned in Iran and Oman.

In Asia the water shortage is especially acute. It is estimated that 29 out of the 48 countries in the Asia Pacific region lack water security. Despite some progress, demand continues to outstrip supply. It is reported that China, after increasing desalination capacity by 70% between 2006 and 2010, has missed its desalinated water production targets in recent years (1).

This is hampering industrial projects, which are forbidden by law to draw on local water tables and are therefore forced to supply their water. One of the major ongoing projects is taking shape in Tangshan in Bohai Bay, where a desalination plant is being constructed to supply potable water to Beijing, 170 miles away. In January 2016 Black & Veatch announced it has won contracts for two projects, one in Hong Kong and the other in Singapore. Elsewhere is Asia, desalination plants have been announced for India, Kazakhstan and Bangladesh in the last year.

In Europe, the desalination leader is undoubtedly Spain. The country supplies much of the expertise that makes many of the world’s plants function. It was also the first European country to adopt desalination (Lanzarote, 1964). By 2013, 27 plants had been built, 13 were under construction and work on 11 more was still to start. However, the country has been suffering from over-capacity since the economic crisis of 2007, with desalination caught between rising fuel costs and lack of demand. Nevertheless, Campo Dalías, built by Veolia, was started up in October 2015. It is an RO plant with isobaric chambers that recover up to 95% of the brine pressure which is then transferred to the feed in order to reduce pumping requirements.

Green energy

Other important technological trends include desalination plants powered by green energy. These are especially suitable in hot dry countries, or in remote locations, such as islands, where a smaller scale is required. Solar is the favorite renewable source, but wind and wave solutions have also been proposed or adopted. Wind has been considered as a candidate energy source for desalination, especially in dry regions such as Texas in the United States, where wind power is already used and there is ample brackish water waiting to be tapped. Wave power operates by converting kinetic energy from ocean swell into electrical power that fuels the RO desalination process.

For example the CETO system developed by Carnegie Wave Energy in Perth, Australia, uses submerged buoys actuated by ocean swell to drive pumps that pressurize seawater delivered ashore by a subsea pipeline. Once ashore, the seawater can either drive a turbine to generate electricity to supply an RO plant. As of January 2016 six demo projects have been carried out.

Other innovations

Other areas where innovation is being applied include: Capacititive deionization. Dutch desalination company Voltea is developing its electro-desalination membrane capacitive deionization (CapDI©) technology, which will remove salts and other dissolved solids from water by applying electric fields across the water flow. Up to 90% of treated water is recovered during this process, a big step towards more efficient water use. Gravity-assisted RO. Another Dutch company, Elemental Water Makers, has invented an RO system that is enabled by using the power of gravity through a saltwater buffer installed at a higher level of elevation.

Desalination and materials

Special metals used in desalination include stainless steel, superaustenitics and titanium. The more critical grades are used above all in evaporators, pumps, valves and piping in order to defend against corrosion in a high-temperature, high-pressure chloride conditions. Conditions are most severe at the intake phase, because of the impurity of the water. The whole range of austenitics and superaustenitics can be used, from 316L and 317L in low or zerochloride environments to 904L and 254SMO in severer chloride environments.

In many applications duplex is proving to be competitive with austenitic or superaustenitic equivalents: the lean grades, the standard 2205, super duplex grades such as SAF2507 and hyper duplex SAF2707 HD and SAF3207 HD all offer higher hardness, a better strength-toweight ratio, lower nickel content and comparable corrosion resistance. Apart from being highly corrosionresistant, titanium offers almost complete immunity to erosion caused by sand.

Titanium is used in condenser tubes and heat exchanger tubes. Nippon Steel & Sumitomo Metal supplied about 6,200 tons of welded titanium pipes to the Ras Az Zawr Project in Saudi Arabia. In 2015 Vallourec Heat Exchanger Tubes supplied more than 2,800 km (!) of tubes for the Shoaiba desalination plant, also in Saudi Arabia.

Desalination types

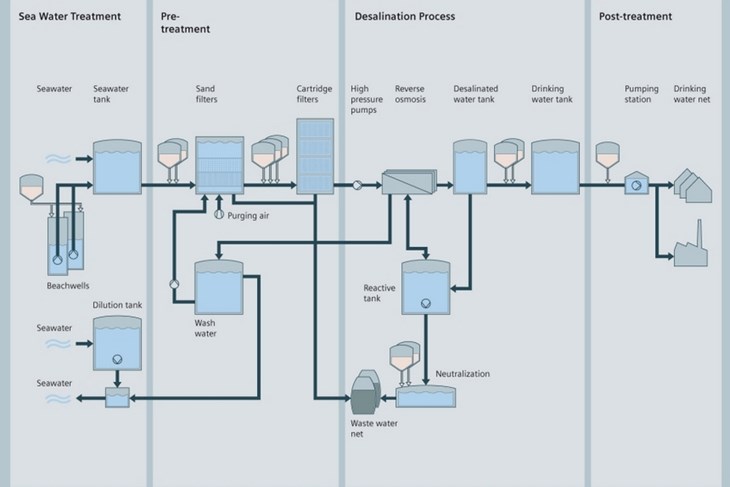

Desalination plants fall loosely into two families, thermal and membrane. In the first type the water is evaporated and distilled so as to remove its impurities. The main technologies used are MED (multi-effect distillation) or MSF (multistage flash). The second usually relies on reverse osmosis (RO), in which the water is pushed through membranes that are porous to water but not the minerals that are left behind. When relying on seawater, the technology is known as SWRO. Thermal processes require more energy than membrane processes, and have found most favour in the oil-rich countries of the Middle East. However, the second type is gaining market share as it consumes less energy.

Conclusion

The innovations outlined above show that desalination’s technological evolution is far from over. The advances made in energy and water recovery and in renewable energy use, the economies of scale brought about by large plants and the flexibility and modular structure of smallscale plants are all factors that increase the economic viability of desalination. From the point of view of suppliers, it has to be said that these types of innovation will result in less piping and fewer pumps and valves per output, but this will be offset by the number of projects as desalination is seen to be more attractive.

Reference

(1) Figures from the International Desalination Association (www.idadesal.org).

___

To read the complete article, please contact

Joanne Mcintyre for a PDF copy.

___

Did you enjoy reading this web-article?

If you haven’t already, why not subscribe to our magazine?