The Champion Field is a complex oil and gas field owned and operated by the Brunei Shell Petroleum, which is jointly owned by Shell and the Bruneian government.

Photo: Wikipedia, https://commons.wikimedia.org/wiki/User:DeltaSquad833 – Own work.

With China’s growth rate letting up in recent years, South-East Asia has become one of the world’s fastest growing economic regions. Dominated by the sprawling archipelago of Indonesia and including as its strategic hub Singapore, the region excels in several industries, including auto, health care, energy and petrochemical, served by the rapidly expanding sectors of nickel and stainless steel.

By James Chater

Introductory

First China, then India, then South-East Asia. This vast and disparate region, with a population of around 600 million, is experiencing rapid economic growth thanks to its low costs, abundant resources and strategic position between the Indian Ocean and the Pacific. The countries of the region co-operate economically though the ASEAN trading bloc and other forums and associations.

Indonesia dominates, in terms of both its demographic size and its GDP, which is over double that of any of the other countries. It has abundant minerals and agricultural resources and is the country with the world’s largest nickel ore deposits, about 22% of the world’s total. It is a major producer and exporter of refined nickel and nickel pig iron and is the only South-East Asian country to have an aircraft industry. Thailand is a major exporter of industrial goods and food, as well as being a magnet for tourists.

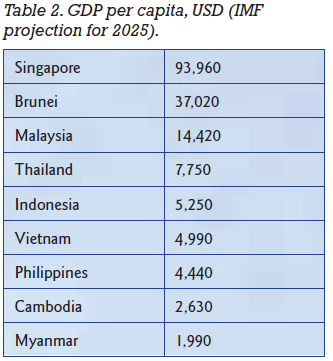

Singapore, though small, is the richest country of the region in terms of per capita GDP. Its vast port, strategic location overlooking a strait connecting the Indian and Pacific Oceans, its business-friendly outlook and use of the English language make it an important regional and global hub. The fastest growth is found in the still relatively poor countries of Vietnam and the Philippines, while Malaysia and Brunei are notable for their plentiful oil and gas reserves. Laggards include Myanmar and Cambodia, though the latter is growing fast.

Most of the region’s governments prioritize growth, foreign investment and the eradication of poverty. Vietnam has a socialist economy akin to China’s. Indonesia has a more mixed economy, and its recently announced downstream industrialization strategy, known as hilirisasi, aims to shift the country away from reliance on its natural resources with an investment of 600 billion USD. As part of its efforts to incentivize downstream manufacturing, Indonesia imposed a ban on nickel ore export in 2020. As a result, there has been a surge in the export of nickel intermediate products and stainless steel, largely thanks to Chinese investments, notably the Indonesia Morowali Industrial Park (IMIP) in Central Sulawesi.

Despite strong growth in recent years, the region’s economic weight is only roughly the same size as India and is dwarfed by that of China. The ASEAN countries’ nominal GDP is forecast to be 4,249,317 million USD in 2025 compared to India’s 4,271,922 million USD and China’s 19,534,894 million USD (IMF projections).

Industries

Hydrocarbons

Rapid growth usually goes hand in hand with a buoyant energy sector, and South-East Asia is no exception. The main net exporters are Malaysia and Brunei, while Indonesia is the largest oil producer. Large oil fields include Exxon Mobil’s Banyu Urip Complex in East Java and Pertamina’s Rokan PSC in Riau and Offshore North West Java PSC (all in Indonesia) and Gumusut-Kakap (Malaysia). Malaysia’s largest company and primary energy producer is state-owned Petronas, whose main product is gas, though it is looking to diversify into oil and boost its activities in Indonesia and further afield, especially the Americas, where it already has a strong presence. Another company that is bolstering its presence in Indonesia is Italy’s Eni, which has been given the green light to develop its gas and condensate gas assets.

South-East Asia is experiencing a boom in LNG facilities. Vietnam’s first import terminal, in Phu Mai in the south, opened in 2023, and a second is being built by US company Excelerate in Hai Phong in the north. Both plants will supply new combined-cycle power plants, of which 13 are planned by 2030. Wood is building Singapore’s second LNG Terminal, including an FSRU. The Philippines, Thailand and Myanmar are also LNG-importing nations. Hydrogen, ammonia, chemicals and petrochemicals are also important industries. The main petrochemical hub is Singapore’s Jurong Island, the result of an ambitious land reclamation project started in 1995. Here are congregated a vast assortment of global companies, including Air Liquide, Baker Hughes, Chevron Phillips, DuPont, Exxon Mobil, Linde, Shell Eastern Petrochemicals Complex, Mitsui Chemicals and Sumitomo Chemical, to name only a few. Vietnam’s fi rst integrated petrochemical complex, Long Son, has been built by a Thai company, SCG Group, and started operations on 30 September 2024.

Power generation

Most of the region’s electricity is generated from coal, the highest proportion being in Indonesia and the Philippines (around 60% in both cases). However, Indonesia is shifting towards more use of green power and aims to be carbon-neutral by 2060. In this respect it has two advantages: vast nickel reserves, essential for lithium batteries and catalysts, and enormous potential for geothermal power. With 40% of geothermal resources, it is already the world’s second-largest producer of geothermal energy. Indonesia has also invested in solar power, having just opened a fl oating solar plant in West Java and planning another (Tembesi) in Riau Islands. Laos, Malaysia, Vietnam, Cambodia and Thailand all produce materials and components used in solar panels, and the region exports one-third of the world’s PV modules. Vietnam is planning the Lam Son Clean Energy Production Complex in Ninh Thuan province, combining hydro power, solar power and battery energy storage. Indonesia’s abundant nickel is stimulating the electric vehicle (EV) industry, with Indonesia aiming to achieve 2.5 million EV users by 2025. It is collaborating with Australia in the processing of nickel and lithium, of which Australia has the world’s largest reserves.

Shipping

The region’s extensive coastlines and islands make seafaring inevitable. Among the companies active in this fi eld are TAS (12 contracts with clients from Indonesia and Singapore in the 12 months to 31 May 2024), HD Hyundai Vietnam Shipbuilding (which is expanding its capacity) and MAC Shipping (which has ordered four duplex stainless chemical tankers from Xin Jiangzhou Shipbuilding Heavy Industry).

Infrastructure

As in any other fast-growing regions, South-East Asia’s cities are growing rapidly and straining existing infrastructure. Architecture, construction and transport (railways, roads, ports and bridges) are therefore growth industries. Indonesia has just completed Nusantara Airport, one of 28 airports in the last decade. Singapore is building a large terminal at Changi Airport, adding capacity and increasing the number of destinations to what is already the region’s busiest airport. Other cities in the region are also adding to airport capacity.

One of the most striking buildings to use stainless steel is Singapore’s Helix bridge, made of 2205 duplex stainless steel. Its double-helical design was inspired by DNA.

Other

Other major industries include space (Indonesia, Malaysia, Singapore and Vietnam all have satellite programmes), water (a wastewater treatment plant under construction in Ho Chi Minh City will be the largest in South-East Asia), desalination (Singapore has built fi ve RO plants; other plants exist in Malaysia, Vietnam and the Philippines), medicine, food & drink and semiconductors (of which Vietnam is an exporter, with ambitions to become a production hub by 2050).

Stainless steel

Multinational companies have been flocking to South-East Asia to take advantage of lower costs, raw materials and favourable policies. Indonesia has especially proved a magnet for foreign stainless-steel producers because of its nickel reserves. China, a longstanding trading partner of Indonesia, has invested heavily in Indonesia, including in its nickel-processing industry: Xiangyu Group invested in an integrated stainless-steel mill, and Tsingshan collaborated with India’s Jindal Stainless to set up Glory Metal Indonesia to produce slab. In December it was announced that Taiwanese producer Walsin Lihwa would build a stainless-steel wire rod plant in IMIP.

As a result, Indonesia is now the world’s second-largest stainless-steel producer. Output rose from 680,000 metric tonnes in 2017 to 6,188,181 MT in 2023(1). Most product is exported, local demand being limited. However, Sutindo, a broad-based manufacturing company, launched a coil centre, Stinox Metal Indonesia, offering slitting and shearing. Malaysia saw the opening of an important stockist, E Steel, in 2004.

It supplies 300 and 400 grades to industries such as oil & gas, automotive, medical, machinery and semiconductors. In 2008 Acerinox and Nisshin Steel set up Bahru Stainless to produce rolled products. However, in 2024 the company ceased production and sold the factory to a newly incorporated company, Worldwide Stainless.

Vietnam imports its primary stainless-steel products mainly from Indonesia, lacking production capacity of its own. However, foreign companies have begun to fi ll this gap: China’s Yongjin built a cold-rolled stainless-steel mill in Vietnam (completed in 2022) and is building a stainless-steel strip processing mill; Germany’s VFT Industry is planning to build a factory in the central province of Ha Tinh.

Yongjin’s precision stainless steel strip mill in Thailand has yet to begin construction. Despite its lack of raw materials Singapore is a leader is stainless distribution and fabrication. Distributors include Kian Huat Metal, HH Stainless (distributor of Outokumpu Circle Green® products; Outokumpu also has sales divisions in Vietnam and Thailand) and Singapore Stainless Steel (established in 2013; also offers cutting and welding services). Fabricators include FMB, Brooklynz Stainless Steel (established in 2013; supplies construction projects) and Metline (an Indian specialist in stainless steel plates). Singapore is also the major hub of the region’s 3D printing industry (see box).

Conclusion

South-East Asia is not without problems: there is a history of investments not bearing fruit, and fl uctuations in raw material prices leave Indonesia vulnerable, though it is taking steps to remedy this. Also, there are concerns that the dash for nickel is endangering the environment and worker safety: there have been numerous accidents, including two explosions at a nickel smelter owned by Tsingshan. Nevertheless, South-East Asia remains a region of promise, likely to grow rapidly and develop buoyant and diverse markets for stainless-steel producers.

3D printing

Since 2016, the region has rapidly developed a 3D printing industry. Metal offerings include stainless steel, bronze, nickel, aluminium, graphite and graphine. The leaders are Singapore, Thailand and Malaysia. In Singapore, the universities of Nanyang and Singapore set up research centres in 2016 and 2017 respectively. Biomedicine and healthcare, including surgical and dental implants, are the major customers. In September 2024, doctors at Vinmec Times City International Hospital collaborated with engineers from the 3D Technology in Medicine Center at VinUniversity (Vietnam) to perform a groundbreaking surgery to remove a tumor and reconstruct the patient’s chest using a 3D-printed titanium implant.

References

1. Joanne McIntyre, “INASSDA – serving the Indonesian stainless steel sector”, Stainless Steel World, September 2024.

Acknowledgements

My thanks to Steven Sutiono, President of the Indonesian Stainless Steel Development Association, for his valuable feedback.

About this Featured Story

Appearing in the February 2025 issue of Stainless Steel World Magazine, this Featured Story is just one of many insightful articles we publish. Subscribe today to receive 10 issues a year, available monthly in print and digital formats. – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.