Deep-sea polymetallic nodules represent the cleanest source of battery-grade metals on the planet. Nodules in the Clarion Clipperton Zone of the Pacific ocean contain nickel, cobalt, copper and manganese with no toxic levels of heavy elements, representing a vast and potentially lower-impact resource that could be the future of nickel supply for stainless steels and electric vehicles. Stainless Steel World spoke to The Metals Company, which is developing the technology and science to harvest this resource with minimal environmental impact.

By Joanne McIntyre. Figures & photos courtesy of The Metals Company.

The Metals Company (TMC) team is made up of scientists, environmentalists, engineers, architects, and business leaders who view the climate crisis as the biggest challenge of our time. Electric vehicles (EV) and renewable energy are a key part of the solution, but scaling these technologies will require hundreds of millions of tons of new metals. The company believes polymetallic nodules represent the cleanest source of battery-grade metals on the planet.

TMC has explored the planet’s largest known deposit of polymetallic nodules, located 4.5 km below the surface in the Clarion Clipperton Zone of the Pacific Ocean. A proven metallurgical process derives key metals from these remarkable rocks while generating zero solid processing waste.

What are polymetallic nodules?

Polymetallic nodules are the world’s largest estimated source of battery metals. The nodules – each about the size of a baseball – contain 3.2% nickel equivalent compared to 0.3-1.9% for the world’s largest undeveloped terrestrial nickel reserves.

Formed over millions of years by absorbing metals from seawater, the nodules lie unattached on the abyssal seafloor and are almost entirely composed of usable materials. Unlike land ores, they contain no toxic levels of heavy elements, and producing metals from nodules generates 99% less solid waste, with no toxic tailings. Polymetallic nodules were discovered more than a century ago, but until recently, there was no regulatory body to licence extraction. The United Nations set up the International Seabed Authority (ISA) in 1994 and granted the first license for exploring polymetallic nodules to Nauru Ocean Resources Inc. (NORI) in 2011. TMC now holds rights to the exploration areas NORI, TOML and Marawa in the Clarion Clipperton Zone (CCZ). The nodules within these three areas contain enough nickel, copper, manganese and cobalt resource equivalent to the requirements of 280 million EVs – approximately one quarter of the world’s passenger vehicle flee. The entire area under licence in the CCZ contains enough metal to electrify 4-5 billion electric vehicles.

Polymetallic nodule recovery

The recovery process begins with a seabed collector designed to minimise disturbance while gathering nodules from the abyssal seabed. Nodules travel up a purpose-built riser system to a production vessel and then separated from water and sediment, which are returned below the photic zone to a depth scientifically chosen to have minimal impact. Throughout this process an adaptive management system, a mix of marine hardware and cloud-based AI, creates a virtual replica of the deep-sea environment. This gives eyes and ears to the regulator and various stakeholders during operation, allowing them to have a minimal impact on the marine ecosystem, from surface to seabed. The nodules are shipped ashore via a shuttle carrier for processing.

Why are nodules advantageous?

Polymetallic nodules offer several advantages in addition to their abundance.

- Security – located on the abyssal seafloor in international waters regulated by the ISA

- Low production costs – expected to be the 2nd lowest cost nickel producer on the planet

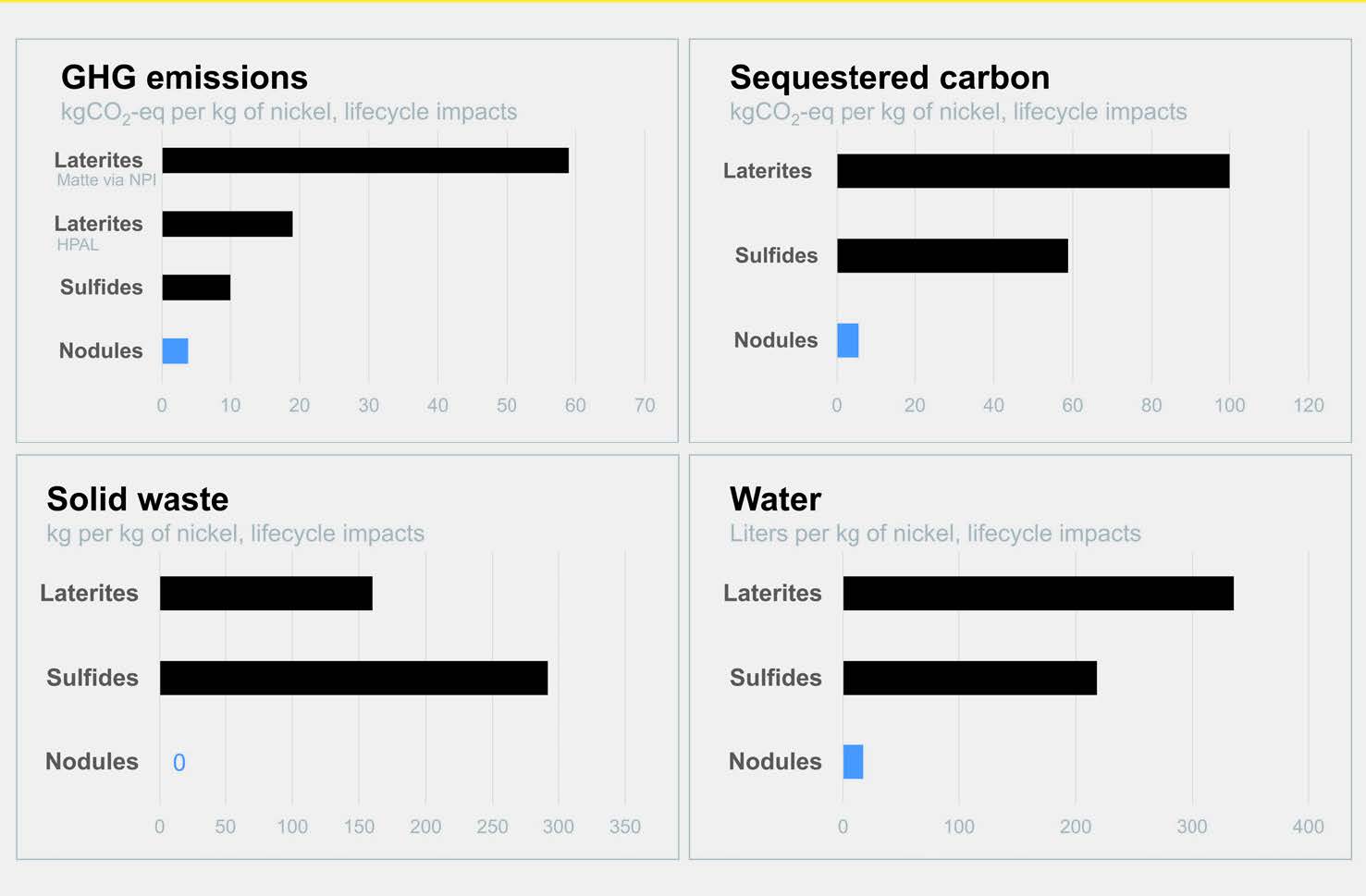

- Low Environmental Social Governance (ESG) cost –70-99%reduction of lifecycle ESG impacts, including near-zero solid processing waste, 90% less CO2 equipment emissions.

In addition to metals, processing the nodules results in an inert manganese silicate useful for steel production; an iron converter slag useful for road construction; and a significant quantity of zero-carbon agricultural grade fertiliser in the form of ammonium sulphate. Furthermore, nodules contain no toxic levels of harmful elements such as hexavalent chromium.

Dramatically reduced environmental impact

Meeting the needs of the clean energy transition is a global challenge. A McKinsey report in 2020 estimated a 40% deficit in nickel supply vs demand by 2030. With most new laterite nickel supplies located in the Philippines and Indonesia below rainforest, extraction significantly impacts biodiversity while releasing vast amounts of carbon locked up in the trees and soil. New terrestrial nickel sources are limited and won’t be enough to meet EV demands in future, let alone the growing demand for new steel in the developing world.

Nodules are a compelling alternative to supply the resources we need with the least possible impact.

Peer-reviewed independent research shows that processing nodules vs conventional nickel extraction reduces carbon emissions by 90%, while solid waste streams and tailings are 100% eliminated (Figure 2).

Using laterite ore generates 75 to 100 tonnes of carbon per tonne of nickel. Using nodules will generate 2 to 3 tonnes of carbon per tonnes of nickel, and TMC has committed to reducing this even further.

Nodule processing in India

TMC has signed a non-binding MoU with Epsilon Carbon to complete a pre-feasibility study for a commercial-scale deep-sea nodule processing plant in India. The targeted production capacity is over 30,000 tonnes per annum (TPA) of an intermediate nickel-copper-cobalt matte product. It will be used for active cathode material (CAM) for Nickel Manganese Cobalt (NMC) and other nickel-rich cathode chemistries for lithium-ion batteries, and more than 750,000 TPA of manganese silicate by-product to be used in manganese alloy production for the steel industry.

Gerard Barron, Chairman and CEO of TMC commented: “Prime Minister Modi’s allocation last year of USD600 million for India’s Deep Ocean Mission and the development of a polymetallic nodule collection system shows the country’s commitment to this new, abundant, secure, lower-cost and lower-ESG-impact potential source of critical metals.”

TMC will supply polymetallic nodules and onshore processing expertise; Epsilon Carbon will finance, engineer, build and operate the Project Zero Plant with a targeted processing capacity of 1.3 million tonnes/annum of wet nodules.

Timeline

The ISA has committed to adopting final exploitation regulations by July 2023. TMC expects to begin initial commercial production by Q3 2024, following its submissions of an environmental and social impact assessment (EISA) in Q3 2023. The basis of the ESIA is extensive environmental and social baseline work spanning five offshore environmental campaigns over ten months. Some of the world’s leading ocean scientists collaborated on the USD75 million deepsea science program. Institutions involved include the Natural History Museum in London; the Universities of Leeds, Gothenburg, Hawaii, Texas and Florida; and the Japan Agency for Marine-Earth Science and Technology. When the results are presented to the ISA they will be supplemented with a pilot small-scale nodule full system test in the CCZ at the end of this year.

Cost-effectiveness

TMC expects to be the cheapest source of nickel outside of Russia. After all, the starting point is a resource containing four valuable minerals in a single ore and valuable by-products (e.g. fertiliser).

Another huge saving is the absence of fixed mining infrastructure such as roads, ports, railways etc to extract the ore then transport it for processing. By contrast, nodules can be shipped to any port for processing, dramatically shortening supply chains and creating significant geopolitical advantages. TMC is reaping the benefits of the current oil & gas industry dynamics; its first recovery vessel, a former drilling ship, was purchased by its partner Allseas for a fraction of its original price. Utilising other dormant oil & gas infrastructure will allow TMC to scale up quickly and cost-effectively when needed. In the long term, the company plans to build bespoke vessels powered by carbon-neutral fuels such as ammonia or hydrogen to achieve environmental impact reduction targets. Once ashore, the nodules will be refined in Rotary Kiln-Electric Furnace (RKEF) lines currently sitting idle, and processed through standard a pyrometallic flowsheet. Slight adjustments will ensure any residues or waste products are recycled to achieve a near-zero solid waste processing flowsheet.

Polymetallic nodules are recognised as a potential game-changer

|

China:

|

|

India:

|

|

France:

|

|

Indonesia:

|