An average capex of USD 18.2bn per year is forecast to be spent on 382 oil and gas fields in Brazil between 2018 and 2020, according to GlobalData.

Capital expenditure into Brazilian traditional oil projects will add up to USD 47.2bn over the three-year period, while heavy oil fields will require USD 6.2bn over the same period. Investments into gas projects in Brazil will total USD 1.1bn in upstream capital expenditure by 2020.

Brazil’s deepwater projects will necessitate USD 5.1bn in capital expenditure over the period. The country’s shallow water and onshore projects will require a capex of USD 3.4bn and USD 1.3bn.

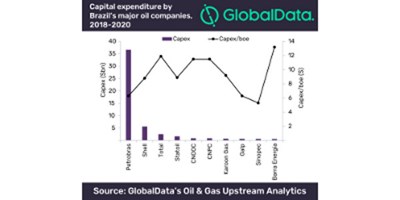

GlobalData expects that Petroleo Brasileiro SA will lead the country in capital expenditure, investing USD 36.6bn into upstream projects in Brazil by 2020. Royal Dutch Shell Plc and Total SA will follow with a total of USD 8.3bn invested into Brazil’s projects over the period.

Ultra-deepwater producing Libra field will lead capital investment with USD 4.8bn to be spent between 2018 and 2020, followed by planned ultra-deep field Lula Oeste with a capex of USD 4.1bn, and another planned ultra-deep field Buzios V (Franco) with a capex of USD 3.4bn.