China will use 63.8% of the world’s primary nickel in 2024, with demand forecast to increase by +8.1% in 2024. Pictured is the control room at Baotou Steel, China. Image courtesy of World Steel Association.

Government and industry representatives met for the International Nickel Study Group meetings, during which the Group reviewed its forecasts for nickel production and use for 2024. This article gives a brief overview of recent developments based on the data finalised at the meetings.

By Ricardo Ferreira, INSG Director of Market Research and Statistics & Francisco Pinto, INSG Manager of Statistical Analysis

Projections for world economic growth in 2024 show a stabilisation at 2.6% (World Bank, Global Economic Prospects, June 2024). This is “nearly half a percentage point below its 2010-19 average”. Geopolitical tensions and high interest rates are among the risks affecting the economy. There are also concerns regarding more restrictive trade policies.

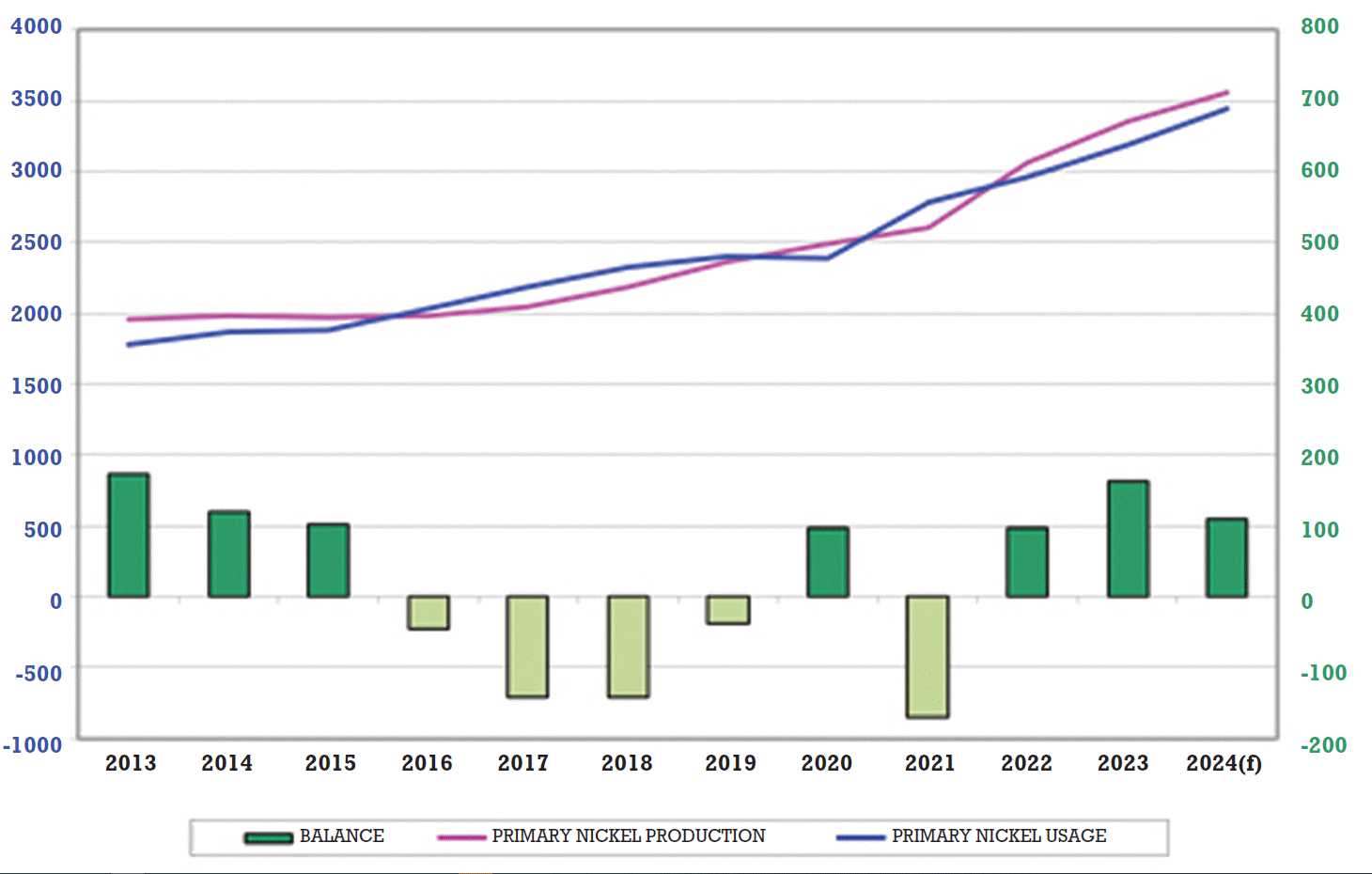

During its April 2024 meetings, the INSG revised its forecast for the nickel market balance for 2023 to a surplus of 163 thousand tonnes (kt). Primary nickel production in 2023 reached 3.356 million tonnes (Mt) while usage was estimated at 3.193Mt. Preliminary figures for 2024 indicated a smaller surplus of 109kt, with production forecast to rise to 3.554Mt and use to reach 3.445Mt.

Primary nickel production

In 2024, world primary nickel production is forecast to rise by +5.9% after increasing by +17.2% in 2022 and by +9.7% in 2023.

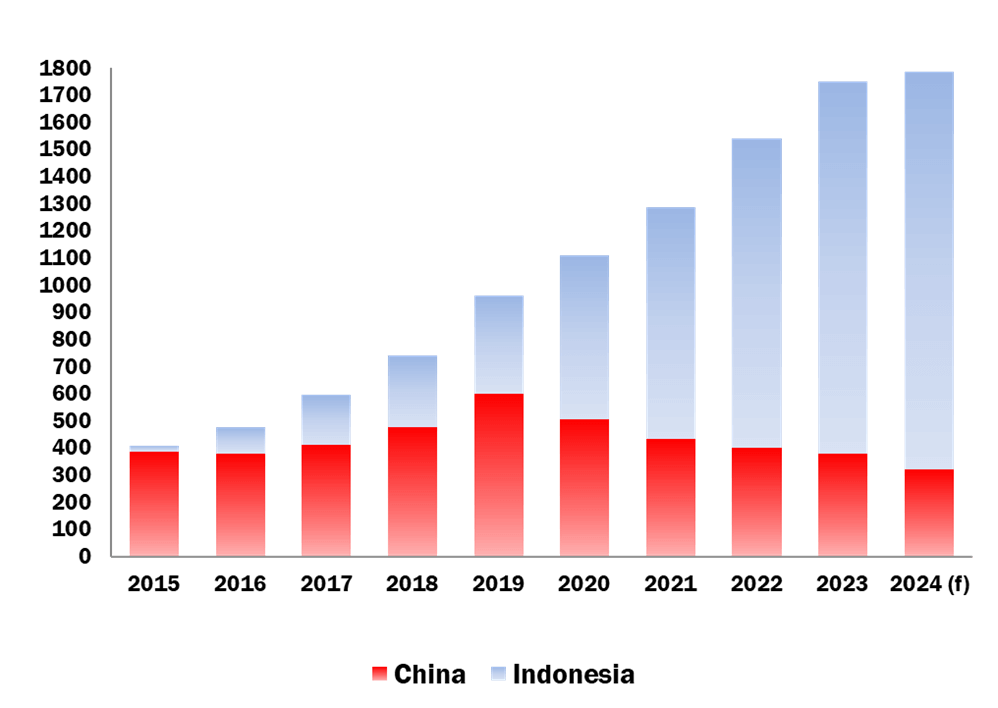

Asian primary nickel production was 2.592Mt in 2023 (+17%) and is forecast to reach 2.842Mt in 2024 (+9.6%), with Indonesia raising output to 1.410Mt in 2023 and 1.570Mt in 2024, consolidating its position as the world leader, followed by China with 970kt and 1.065Mt respectively. Both countries will increase nickel sulphate and cathode production this year.

Combined Chinese and Indonesian NPI production is estimated at 1.75Mt in 2023, and is projected to increase to 1.785Mt in 2024. China’s output started to decline in 2019, in contrast to Indonesia, where production has ramped up over the last decade. However, this year Indonesia has delayed the issuance of quotas for nickel mining, leading to shortages. As a result, some companies have been importing ore from the Philippines to maintain production levels.

Last year, Indonesia started producing nickel sulphate (Lygend) and nickel cathode (CNGR). Currently, these projects are ramping up, with exports of both products increasing. On 23 May 2024, the LME approved the listing of CNGR’s brand, which contains a minimum of 99.8% pure nickel and belongs to PT CNGR (Ding Xing New Energy) with a production capacity of 50kt per year.

All the remaining regions of the world are forecast to decrease primary nickel production in 2024, mainly due to low or negative profitability caused by low nickel prices. In Africa, production declined by -0.5% in 2023 and is expected to further decrease by -5.4% in 2024. The Americas are forecast to have negative growth of -4.7% in 2024, after falling -17.5% in 2023. European production decreased by -7.1% in 2023 and is projected to further decline by -0.9% in 2024. In Oceania, output recovered in 2023, with an increase of +0.9%, but is expected to fall by -20.2%in 2024.

Several traditional ferronickel producers recently ceased production: Larco in Greece (August 2022), Solway Pobuzhskiy in Ukraine (November 2022), Solway FeNix in Guatemala (January 2023), Americano Nickel Falcondo in the Dominican Rep. (mid-2023 line 1 and December 2023 line 2), Yildrim NewCo Ferronikeli in Kosovo (November 2023), GSO Kavadarci in North Macedonia (December 2023), SMSP/Glencore Koniambo in New Caledonia (February 2024), and Tagaung Taung in Myanmar (2024). In Japan, Pacific Metals Hachinohe (2022/2023) and SMM Hyuga (mid-2022) reduced production.

Some Australian producers have also closed operations: Malle Resources Avebury (February 2024), Panoramic Resources Savannah (January 2024), and First Quantum Ravensthorpe (May 2024). The first two produced nickel ore and the third mixed hydroxide precipitate. Additionally, BHP scheduled the re-evaluation of its Western Australia Nickel operation for August 2024.

Russia’s Nornickel and Ambatovy in Madagascar will also likely reduce production this year.

Primary nickel usage

World nickel usage has grown steadily since 2009, with the only exception being 2020, when it declined by -0.6%. In 2024, usage is forecast to increase by +7.9%, to reach 3.445Mt. All world regions are expected to expand, with China recording the biggest increase in absolute volume.

In 2024, Asia will account for 86.8% of global primary nickel usage, reinforcing its dominant position (as a reference, Asia’s share in 2010 was “only” 63%). Demand in China P. R. is forecast to increase by +8.1% in 2024, after rising +16.3% in 2023. The country is the largest consuming market in the world. It will use 63.8% of the world’s primary nickel in 2024, an estimated increase of 0.2 percentage points from 2023. In terms of quantity, the main driver is the stainless steel (STS) sector, though batteries are growing fastest in percentage terms, although the rate of growth is now showing some signs of slowing.

Indonesia started producing STS in 2017 and became the second most important nickel user globally in 2020 (with usage of 210kt, surpassing that of Japan).

The country had a strong increase in 2021, reaching 383kt, but due to import restrictions on Indonesia STS in a number of countries demand decreased in both 2022 and 2023. Consumption is likely to recover in 2024 to a level of 400kt.

Nickel usage in Europe is expected to recover by +2.0% in 2024, after declining by -3.7% in 2023. There were strikes at some STS mills in several European countries with the full effect not yet fully assessed, so there is uncertainty regarding nickel consumption in the current year. In the Americas, usage is projected to further expand by +5.4% in 2024 (+1.9% in 2023), led by the US with a +5.8% growth rate. Demand in Africa decreased in 2023 (-26.6%), however a recovery is anticipated in 2024 (+3.8%).

The STS sector remains the most important first-use market for nickel, although its share has been slowly declining since it peaked in 2020, because of the growing electrification of vehicles. It is projected to decline to around 68% in 2024. Higher demand for nickel to produce lithium-ion batteries will likely lead to a bigger proportion of the market accounted for by this sector over the coming years. The nickel-based alloy sector has also performed well, especially in China.

The World Stainless Association (former International Stainless Steel Forum / ISSF) released figures for the full year of 2023 showing that “stainless steel melt shop production increased by 4.6% year–on–year to 58.4 million metric tons”, after increasing by +12.5% in 2021 and decreasing by -4.2% in 2022. At its annual industry conference in May 2024, the Association stated that “global stainless steel consumption growth was forecast to be at +3.9% in 2024 and at +3.2% in 2025”.

As reported by the consultant “EV Volumes”, global sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) “grew 35% year-on-year in 2023 to reach 14.2 million units, equating to a market share of 16.7%, up from 13.6% in 2022. For the first time since 2020, PHEVs (up 47%) grew faster than BEVs (up 30%)”. For 2024, the consultant expects “16.6 million EV sales, equating to a 19.2% share of the light-vehicle market. Therefore, plug-in deliveries are forecast to grow by 17%, while the total market is only expected to improve by 1%”.

In China, annual production of ternary precursors used to produce different types of nickel-containing batteries rose consistently up to 2022, reaching 320kt in 2020, 634kt in 2021, and 843kt in 2022, according to MySteel. However, output dropped to 793kt in 2023 and further declined by -2.8% over the first 6 months of 2024 (provisional figures).

In terms of the split of China’s production of ternary precursors, NCM622 chemistry gained market share in 2023, representing almost 31% of the total (18% in 2020, 24% in 2021, and 28% in 2022), but high-nickel NCM811 fell back to 38% (21% in 2020, 29% in 2021, and 42% in 2022). From January to April 2024, provisional figures indicate NCM622 at around the same level as the previous full year, and NCM811 recovering by one percentage point.

Over the last year the rate of growth of nickel use in batteries for electric vehicles (EV) has been weaker than anticipated, negatively affected by the removal of subsidies, competition from non-nickel batteries (mainly lithium iron phosphate) and a recent relative preference in demand for PHEVs over battery EVs.

Critical minerals

A number of minerals and metals have been identified as critical or strategic for the energy transition, and different countries have been developing their own initiatives with regard to those minerals and metals, including nickel. These include the following:

- China announced in 2016 their National Mineral Resources Plan for 2016-2020, with nickel included.

- The USA has 2 critical minerals lists specified by the US Geological Survey (2022) and the Department of Energy (2023) – nickel is part of both. Minerals on the DOE list are eligible for Inflation Reduction Act (IRA) incentives.

- The European Commission expanded its critical raw materials list to 34 commodities, 17 of

which were considered ‘strategic’ (including nickel), in March 2024. - Japan’s resource strategy dates back to the mid-1980s – in 2018, the government released a Critical Minerals Report, with 31 minerals designated as critical (nickel was included).

- India released a list of 30 critical minerals (nickel included) in July 2023.

- South Korea designated 33 key minerals and selected 10 of them as strategic key items (including nickel) in February 2023.

- Australia has updated its list of critical minerals and created a new list of strategic materials (including nickel, so producers with financial problems may have access to financing) in December 2023.

- The UK’s 2021 critical minerals list includes 18 minerals; in 2023, the government released a strategy update (nickel was included on a watchlist).

- Canada released a Critical Minerals Strategy in 2022 and its Critical Minerals List in 2022. This included 31 metals and minerals (nickel was part of a “prioritised” list of 6 minerals).

On 26th April 2024, the United Nations Secretary-General launched a Panel on Critical Energy Transition Minerals, with the following objectives: “support a just and equitable transition to renewable energies while harnessing critical energy transition minerals for sustainable development”; “ensure countries and local communities endowed with these minerals fully benefit economically, including through local value addition, while safeguarding social and environmental protections for affected communities and ecosystems”; and, “strengthen international cooperation including through the alignment and harmonisation of existing norms, standards and initiatives and agree on areas for enhanced multilateral action”. Further contributing to this important topic, the International Nickel Study Group, together with its sister organisations International Copper Study Group and International Lead & Zinc Study Group, will organise a Joint Seminar on “Critical Minerals Initiatives and Strategies” on 25 September 2024, as part of their Autumn 2024 meetings.

Nickel prices and stocks

Lastly, we will briefly analyse trends in nickel prices and exchange stocks in 2023 and the beginning of 2024.

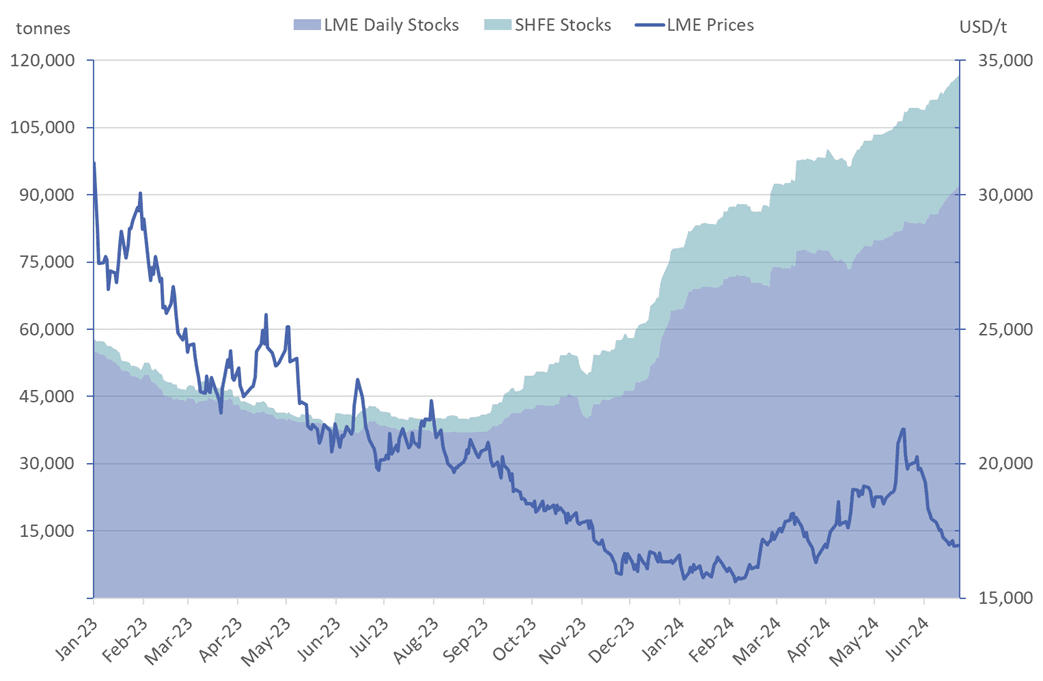

In 2023, the London Metal Exchange (LME) nickel price (close, cash settlement) nearly halved from 31,200 USD/t at the start of the year to 16,300 USD/t by year’s end. In mid-September 2023, prices fell below 20,000 USD/t for the first time since December 2021, oscillating between 15,500 USD/t and 17,000 USD/t until late February this year, with a low of 15,620 USD/t on 6 February. A price rally began thereafter, coinciding with news of nickel capacity shutdowns in the face of low prices, delays in Indonesian mining quota approvals and reports of short covering at the LME. The rally peaked at 18,135 USD/t in mid-March. Prices had retreated to 16,330 USD/t by the end of March, coinciding with hopes of faster mining quota approvals in Indonesia. April saw a second rally and prices surpassed 19,000 USD/t by mid-month. The upturn extended into the second half of May, with prices exceeding 20,000 USD/t and peaking at 21,275 USD/t on May 21 with investment fund money reportedly flowing into precious and base metals. However, by the end of the third week of June prices had declined to 16,935 USD/t, consistent with reports of cooling speculation and faster Indonesian ore quota approvals. Combined LME and Shanghai Futures Exchange (SHFE) nickel stocks began 2023 at approximately 57,900 t with destocking occurring at an average pace of about 4,000 t per month up until May. On 16 June, the LME recorded its lowest nickel stock level since 2007 at 36,810 t, while SHFE stocks hit an all-time low of 506 t in the last week of May (the contract was launched in 2015). Combined stocks bottomed out on 1 June 2023 at 38,162 t. Levels then hovered between 39,700 t and 44,000 t until mid-September. Since then, combined end-of-month stocks have been increasing every month by an average of about 7,400 t, with a significant surge of nearly 19,000 t in December (dominated by a 17,800 t increase in the LME). The share of nickel stocks held at LME and SHFE warehouses has fluctuated – while in May last year, 99% of exchange stocks were at LME sites, last May the split was 77% to 23% (LME and SHFE, respectively).

LME end-of-month off-warrant stocks reached 54,153 t in April this year, the highest figure since reporting began in February 2020.

About this Featured Story

Appearing in the August 2024 issue of Stainless Steel World Magazine, this Featured Story is just one of many insightful articles we publish. Subscribe today to receive 10 issues a year, available monthly in print and digital formats. – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.