Government and industry representatives met on the 23rd and 24th of September 2024 for the most recent International Nickel Study Group meetings, during which the Group reviewed its forecasts for nickel production and use for 2024 and 2025. This article gives a brief overview of recent developments and is based on the data finalized at the meetings.

By Ricardo Ferreira, INSG Director of Market Research and Statistics & Francisco Pinto, INSG Manager of Statistical Analysis

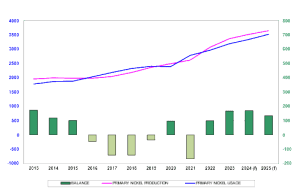

During its September 2024 meetings, the INSG revised its forecast for the nickel market balance for 2024 to a surplus of 170 thousand tonnes (kt). Primary nickel production in 2024 was projected to reach 3.516 million tonnes (Mt) while usage was estimated at 3.346Mt. Preliminary figures for 2025 also indicated a surplus of 135kt, with production forecast to rise to 3.649Mt and use to reach 3.514Mt.

Primary nickel production

In 2024, world primary nickel production is forecast to rise by +4.6%, after increasing by +9.8% in 2023. In 2025, further growth of +3.8% is anticipated.

Source: INSG (September 2024)

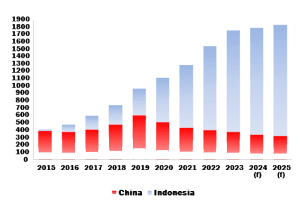

In Asia, primary nickel production is forecast to reach 2.843Mt in 2024 (+9.6%) and 3.002Mt in 2025 (+5.6%), with Indonesia raising output to 1.600Mt and 1.700Mt, consolidating its position as world leader, followed by China with 1.035kt and 1.085Mt, respectively. Both countries will produce more nickel sulphate and cathodes (Indonesia started production of these products in 2023).

Combined Chinese and Indonesian NPI production is projected to increase to 1.790Mt in 2024 and to 1.830Mt in 2025. However, the trends in each country are contrasting as China’s output has declined since 2019 and Indonesia has ramped up production over the last decade. More recently, Indonesia has delayed the issuance of quotas for nickel mining (RKABs), leading to supply shortages and, as a result, some companies have started importing ore from the Philippines in order to maintain NPI production levels. Additionally, discussions are taking place in Indonesia to limit new licenses for NPI capacity in the future whilst, at the same time, Indonesian NPI has been exported to European stainless steel mills to be tested as a possible feed.

Last year, Indonesia started producing nickel sulphate (Lygend) and nickel cathode (CNGR). Currently, these projects have continued to ramp up with export volumes increasing.

Sources: INSG, Antaike, SMM, MySteel

On the 23rd of May 2024, the LME approved the listing of CNGR’s brand which contains a minimum of 99.8% pure nickel. The brand is owned by PT CNGR (Ding Xing New Energy), which has an annual capacity of 50,000 tons full-plate metal. This supplements five recent additions from China: Guanxi Huayou New Material (brand HUAYOUgx) 30,000 tons, Jingmen Gem (GEM-NI1) 10,000 tons, Jingmen Gem (GEM-NI2) 20,000 tons, Guanxi CNGR New Energy Science & Technology (CNGR) 25,000 tons, and Quzhou Huayou Cobalt New Material (HUAYOU) 36,600 tons. Combined output from the six brands totals 171,600 tons per year.

All the remaining regions of the world are forecast to decrease primary nickel production in 2024, mainly due to depleted or negative profitability caused by low nickel prices. European production is forecast to decline by -1.2% in 2024 and -0.7% in 2025. The Americas are forecast to have negative growth of -15% in 2024 and to recover by +7.8% in 2025. In Oceania, output is expected to fall by a significant -31.2%in 2024 and by a further -38.9% in 2025. In Africa, production is expected to decrease by -5.8% in 2024 but then to rebound by +5.6% in 2025.

Outside Asia, a number of nickel producers have reduced output or suspended operations. In Australia, production is now halted at Malle Resources’ Avebury (since February 2024), Panoramic Resources’ Savannah (January 2024), First Quantum’s Ravensthorpe (May 2024) and BHP’s Western Australia Nickel operations (October 2024). Ambatovy, in Madagascar is likely to continue operating, but at a lower level than previously. Conversely, Russia’s Nornickel reduced production in 2023 but are likely to keep output stable at current levels.

Looking specifically at ferronickel, over the past 3 years a number of traditional producers have ceased production:

Larco in Greece (August 2022), Solway Pobuzhskiy in Ukraine (November 2022), Solway FeNix in Guatemala (January 2023), Americano Nickel Falcondo in the Dominican Rep. (mid-2023 line 1 and December 2023 line 2), Yildrim NewCo Ferronikeli in Kosovo (November 2023), GSO Kavadarci in North Macedonia (December 2023), SMSP/Glencore Koniambo in New Caledonia (February 2024), and Tagaung Taung in Myanmar (2024). Additionally, in Japan, Pacific Metals Hachinohe (2022/23) and SMM Hyuga (mid-2022) reduced production. Among the operations mentioned most remain closed with the exception of Tagaung Taung which is currently restarting. There is also speculation that FeNix and NewCo Ferronikeli could restart in the near future.

Primary nickel usage

World nickel usage has grown steadily since 2009, with the exception of 2020, when it declined by -0.6%. In 2024 and 2025, usage is forecast to increase by +4.8% and +5.0%, respectively, with China being the main contributor in absolute terms in both years.

Asia will account for 86.7% and 86.8%of global primary nickel usage in 2024 and 2025, respectively, reinforcing its dominant position (as a reference, Asia’s share in 2010 was 63%).

Primary nickel demand in China is forecast to rise by +4.4% in 2024 and by further +4.9% in 2025. The country is the largest consuming market in the world and will use 63.5% of the world’s primary nickel in both 2024 and 2025. In terms of first use, Chinese demand continues to be mainly driven by trends in the stainless steel (STS) sector though the infl uence of the battery sector is growing.

Indonesia started producing STS in 2017 and became the second most important nickel user globally in 2020 (with usage growing to 210kt, surpassing that of Japan). Demand in the country rose strongly in 2021, reaching 383kt, but due to imports restrictions on STS applied by several countries it decreased in 2022 and again in 2023. Consumption is predicted to recover in 2024 to a level of around 390kt and rise again by 9% in 2025.

Indonesia is also aiming to develop a downstream battery and electric vehicles industry. Last October, the Indonesia Battery Corporation (IBC) and Contemporary Amperex Technology (CATL) formed a joint venture (JV) to build a battery cell manufacturing plant and CNGR announced plans to build a US$10 billion battery material facility in the country. Those announcements add to previous ones in the value chain. In the future, it is likely that we will see Indonesia using more of its nickel resources in finished products.

After declining in 2023, nickel usage in Europe is expected to recover modestly in 2024 by +0.7% and then strongly in 2025 by +3.6%. Economic difficulties and strikes in some European STS mills have affected production over the last two years. In the Americas, usage is projected to expand by +3.1% in 2024 and by 3.2% in 2025, driven by the United States with a +2.5% growth rate in 2024 and +3.3% in 2025.

Demand in Africa decreased in 2023 (-26.6%), but a recovery is anticipated in 2024 (+8.7%) and 2025 (+34.5%). A new battery plant is planned to start production in Morocco by 2025, which will spur nickel usage in the region.

The STS sector remains the most important first-use market for primary nickel, although its share has been slowly declining, since it peaked in 2020, because of the growing use of nickel in EVs. In 2024, the proportion of nickel used in STS is projected to decline further to around 69%. Higher demand for nickel in order to produce lithium-ion batteries will likely lead to a bigger proportion of the market accounted for by this sector over the coming years. The World Stainless Association (former International Stainless Steel Forum / ISSF) released figures for the first half of 2024 showing that “stainless steel melt shop production increased by 6.3% year–on–year to 30.4 million metric tons”. At its annual industry conference in October 2024, the Association stated that the world stainless steel consumption growth was forecast to be at +4.0% in 2024 and at +3.0% in 2025.

Electric vehicles

The rate of growth of nickel use in batteries for electric vehicles (EV) has been weaker than anticipated, negatively affected by the removal of subsidies, competition from non-nickel batteries (mainly lithium iron phosphate) and a recent relative preference in demand for plug-in hybrid electric vehicles (PHEVs) over battery EVs (BEVs). Nevertheless, it has been increasing.

Rho Motion data shows that from January to September 2024 global passenger EV sales improved 23.5% year-on-year (YoY), reaching 11.62M vehicles. Sales of PHEVs rose strongly by 50% YoY, while sales of BEVs rose by only 12.4% YoY. In terms of the regional split, China accounted for 62% of the world sales from January to September 2024 for total EVs (BEVs plus PHEVs), an increase from 56%. Europe accounted for 20%, a decrease from 24% in the previous year. The proportion accounted for by the USA also declined, but only marginally – from 11% to 10%. In the rest of the world there was a small rise from 8% to 9%. The Chinese battery market is dominated by non-nickel bearing LFP chemistry which accounts for more than 60% of the batteries used in EVs. Additionally, PHEVs, that use smaller batteries than BEVs, had an impressive growth of 77% YoY in the country, increasing their share among new energy vehicles.

According to Mysteel, Chinese annual production of ternary precursors used to produce different types of nickel-containing batteries grew consistently until 2022, reaching 320kt in 2020, 634kt in 2021 (+98%) and 843kt in 2022 (+33%), but declined to 793kt in 2023 (-5.9%). Over the first 10 months of 2024, provisional figures indicate that production decreased by a further -4%. NCM622 precursors gained market share last year, representing just below 31% (18% in 2020, 24% in 2021, and 28% in 2022). This was at the expense of higher-nickel containing NCM811 precursors which suffered a fall to 38% (21% in 2020, 29% in 2021, and 42% in 2022). However, from January to September 2024, NCM622’s share rose to 31.5% and NCM811’s proportion recovered to almost 40%.

In Europe, the investments in battery plants have been facing difficulties, because of slowing demand growth for electric vehicles, financing issues and increased competition from Asian producers. Some scheduled investments have recently been scaled back, delayed or cancelled. There is also a growing focus on non-nickel containing lithium iron phosphate (LFP) batteries in the region which has negatively impacted the demand for nickel in this sector.

Nickel prices and stocks

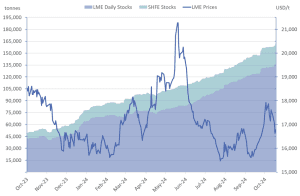

Sources: London Metal Exchange, Shanghai Futures Exchange

Lastly, we will briefly analyse nickel prices and exchange stocks from the end of 2023 until mid-October 2024. In September 2023, the London Metal Exchange (LME) nickel price (close, cash settlement) dropped below 20,000 USD/t for the first time since December 2021, followed by a downtrend that persisted until February this year, with prices hitting a low of 15,620 USD/t on 6 February. After this, prices displayed volatility reaching a peak of 21,275 USD/t on 21 May, apparently influenced by a combination of investment fund money flowing into precious and base metals, Chinese government incentives for the property sector and social unrest in New Caledonia. Prices then declined during June and most of July to a four-year low of 15,470 USD/t on 25 July. This coincided with news of investment funds becoming less bullish, a strengthening of the US dollar and sluggish manufacturing data from China. Since July, prices have fluctuated mostly between 15,500 and 18,000 USD/t, with a dip in early September.

Combined LME and Shanghai Futures Exchange (SHFE) stocks have risen steadily since September 2023. After a low of just above 38,000 tons in early June 2023, a level not seen since 2007, prior to the launch of the SHFE contract, stocks roughly doubled to 77,923 tons by the year-end. During 2024, the rate of end-of-month stock increases decelerated up until April and then picked up. By the end of the third week of October, combined exchange stocks were 163,497 tons, the highest level since September 2021.

Since January 2023, the LME has included reporting of stocks by origin. The recently approved Indonesian and Chinese brands have altered the composition of LME nickel stocks significantly. In September 2023, Australian-origin nickel dominated inventories held in LME warehouses, comprising 50.8% (23,118 tons) of the total of 41,430 tons reported, while Chinese-produced nickel only accounted for 1,236 tons. By the end of September 2024, Chinese material represented the largest share of reported LME stocks at 51,240 tons (41.6% of the total 123,090 tons), followed by nickel from the Russian Federation (29,100 tons) and Australia (24,678 tons).

LME end-of-month off-warrant stocks reached 69,936 t in August, the highest figure since reporting began in February 2020.

About this Featured Story

Appearing in the December 2024 issue of Stainless Steel World Magazine, this Featured Story is just one of many insightful articles we publish. Subscribe today to receive 10 issues a year, available monthly in print and digital formats. – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.