Steel production at Posco, South Korea. Photo by World Steel.

Government and industry representatives met on the 2nd and 3rd October 2023 for the most recent International Nickel Study group (INSg) meetings during which the group reviewed its forecasts for nickel production and use in 2023 and 2024. This article gives a brief overview of recent developments and is based on the data finalised at the meetings.

By Ricardo Ferreira, INSG Director of Market Research and Statistics & Francisco Pinto, INSG Manager of Statistical Analysis

The global economy was impacted positively by the reopening of China and lower energy prices at the beginning of 2023, but tighter monetary policy and higher interest rates to fight inflation are affecting business and consumer confidence. In general, world economic growth in 2023 is expected to be lower than in 2022 and decline further in 2024.

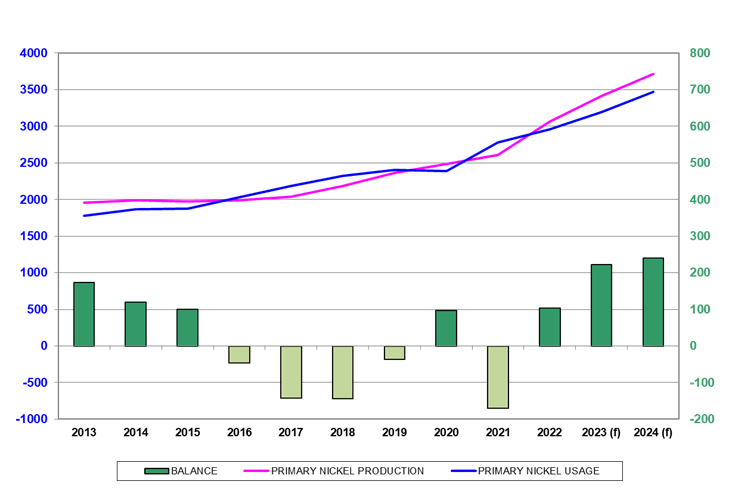

During its October 2023 meetings, the INSG reviewed its forecast for the global nickel market balance for 2023 to a surplus of 223 thousand tonnes (kt). Primary nickel production in 2023 is anticipated to reach 3.417 million tonnes (Mt) while usage is projected at 3.195Mt. Preliminary figures for 2024 indicate a further surplus of 239kt, with production forecast to rise to 3.713Mt and usage to reach 3.474Mt.

Historically, market surpluses have been linked to London Metal Exchange (LME) deliverable/class I nickel, but in 2023 and 2024, the surplus will be mainly related to class II and nickel chemicals (principally nickel sulphate), though in 2024, refined production will likely increase, especially in China.

World primary nickel production, usage and market balance (in 1000 tonnes)

Primary nickel production

World primary nickel production is forecast to rise by almost +12% in 2023 and close to +9% in 2024 after increasing by +17.3% in 2022. Increases in output have been influenced mainly by Indonesia and China. Both countries will have more nickel sulphate and cathode production – the former started producing the two products in 2023. Indonesia will continue to expand nickel pig iron production (NPI), though at a slower pace than in previous years, whilst output in China will continue to decline.

Combined Chinese and Indonesian NPI production was more than 1.5Mt in 2022 and is projected to increase by more than +11% in 2023 and almost +4% in 2024. China’s output started to decline in 2019, and Indonesia has ramped up NPI production over the last decade. On the other hand, Indonesia might limit new NPI licenses in the future, and there is an ongoing corruption investigation that caused delays in the issuance of quotas for nickel mining, leading to supply shortages that required some smelters to import ore from the Philippines to maintain operations. According to the Indonesian Nickel Miners Association (APNI), Indonesia hosts 330 nickel mining companies (as of October 2023), distributed over six

provinces (South, Southeast and Central Sulawesi, Maluku, North Maluku and West Papua). Southeast and Central Sulawesi have the largest concentration with 155 and 116 companies, respectively, while Maluku and West Papua are currently home to 1 and 2 miners. Three more work contracts have been awarded that will increase the total to 333 mining companies, covering 836,000 hectares of nickel concession area.

Considering nickel processing facilities, APNI reports capacities of NPI, ferronickel and matte of 1,659kt/y in operation, 598kt/y under construction and a further 896kt/y planned. For MHP, these capacities are 145kt, 403kt, and 609kt, respectively. This would equate to ore requirements of 178Mt/y (wet) for operating plants (in 2023), 116Mt/y for projects under construction and 174Mt/y for planned projects, resulting in a forecast of about 468Mt/y of ore required by 2026.

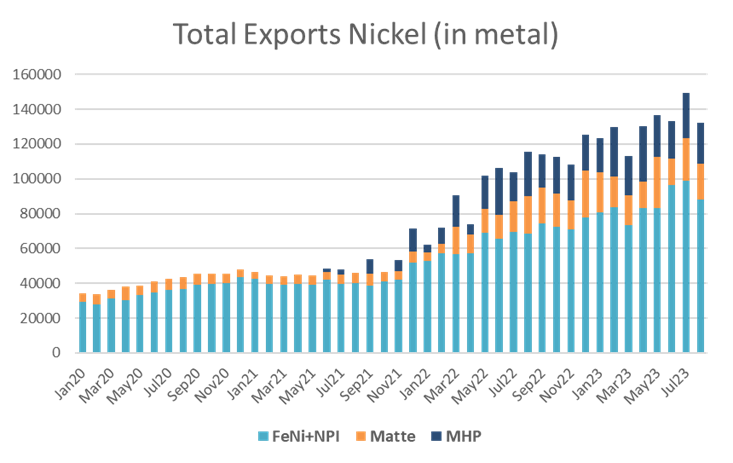

Estimated combined Indonesian exports of ferronickel (FeNi) and NPI (excluding NPI in stainless steel, or STS), nickel matte and mixed hydroxide precipitate (MHP) (in nickel content) surged in 2022, with an increase of more than +100%. From January to August 2023, the growth was +44%, compared with the same months in 2022.

Asian primary nickel production was 2.216Mt in 2022 (+23%) and is forecast to reach 2.626Mt in 2023 (+18.5%) and 2.878Mt in 2024 (+9.6%). Indonesia raised output to 1.390Mt and 1.515Mt, consolidating its position as the world leader, followed by China with 1.020Mt and 1.145Mt, respectively.

In Africa, primary nickel production rose +9.6% in 2022 and is expected to further increase by +1.0% in 2023 and +9.1% in 2024.

The Americas had growth of +8% of primary nickel production in 2022 but are forecast to have negative growth of -13.2% in 2023, followed by a recovery of +8.0% in 2024. Variations in 2023 were primarily due to Canada and Guatemala (ProNiCo’s FeNix smelter was not allowed to produce in 2023; the company is a subsidiary of Solway Investment Group). Canadian production is likely to recover in 2024. News published in the beginning of October refers to the fact that Solway has received new licenses to resume operations.

Despite a recovery in both the Russian Federation and Finland, production growth in Europe was flat in 2022, due to all four ferronickel producers having stopped production as a response to high energy prices and lower demand from STS mills.

At the beginning of April 2023, the North Macedonian smelter resumed production. In 2023, production is likely to decrease in the region by almost -4%, because of anticipated lower output from the Russian Federation, partially compensated by the ramp up of Terrafame’s Battery Chemicals plant, commissioned in June 2021, which will produce nickel sulphate for EV batteries. For 2024, production is forecast to expand by +3.3%, with the ramp up of North Macedonian and Finnish production.

In Oceania, primary nickel production recovered in 2022, with an increase of +4.6%, and is forecast to further rise in 2023 by +3.3% and in 2024 by +3.6%, with growth in both Australia and New Caledonia (France). There is uncertainty regarding the latter due to the fact that the producers and the local government are reevaluating the companies’ profitability.

Estimated Indonesian nickel exports (in 1000 tonnes, nickel content)

Primary nickel usage

World nickel usage has grown steadily since 2009, with the only exception being 2020, when it declined by -0.6%. In 2023 and 2024, usage is forecast to increase by +8.0% and +8.7%, to reach 3,195 Mt and 3,474 Mt, respectively. In both years, demand in all world regions is expected to expand, with the exception of Africa in 2023. China will have the biggest increase in absolute volume.

In 2023, Asia will account for 85.9% of global primary nickel usage, reinforcing its dominant position (as a reference, Asia’s share in 2010 was 63%). Further growth of +9.5% is anticipated in the region in 2024.

Demand in China is forecast to increase by +16% in 2023 and +9.1% in 2024. The country is the largest consuming market in the world. It will use 63.5% of the world’s primary nickel in 2023, with a further increase of 0.3 percentage points in 2024. In terms of quantity, the main driving sector is STS, though the battery sector is growing faster in terms of percentage.

Indonesia started producing STS in 2017 and became the second most important nickel user in 2020 (with usage growing to 210kt, surpassing that of Japan).

The country had a strong increase in 2021, reaching 383kt, but due to import restrictions from several countries, output decreased in 2022. Consumption is likely to decline further to 335kt in 2023 but should recover in 2024 to a level of around 390kt.

Nickel usage in Europe is expected to recover by +0.5% in 2023 and grow by a further +5.1% in 2024. Similarly, in the Americas, usage is projected to expand by +1.4% in 2023 and +2.5% in 2024. In both regions, usage declined in 2022. As mentioned previously, demand in Africa will decrease in 2023 (-4.6%), but a recovery is anticipated in 2024 (+1.9%). The stainless steel sector remains the most important first-use market for nickel, although its percentage share of the market has been slowly declining since it peaked in 2020, because of the growing electrification of vehicles and subsequent demand for EV batteries containing nickel. In 2022, stainless steel accounted for almost 69% of world primary nickel usage (not counting scrap).

The World Stainless Association (former International Stainless Steel Forum / ISSF) released figures for the first half year of 2023 showing that “stainless steel melt shop production decreased by 1.7% year–on–year to 28.4 million metric tons”, after increasing by +12.5% in 2021 and decreasing by -5.1% in 2022. Forecast figures for world stainless steel consumption (as of October 2023) indicate a level of around+1.2% for 2023 and +3.4% for 2024. These figures confirm that demand growth from the stainless steel sector is recovering and is expected to be stronger next year.

As reported by the consultant “EV Volumes”, world sales of EVs reached 9.4 million in the first 9 months of 2023 (+39% growth), after increasing +109%in 2021 and +55% in 2022. EV sales represented 16% of global light vehicle sales so far in 2023, compared to a share of 8.3% in 2021 and 14% in 2022. Year-to-date in 2023, battery electric vehicles (BEVs) had a share of around 11% (over 6.5 million) with plug-in hybrid electric vehicles (PHEVs) accounting for the remaining 5% share (more than 2.8 million), while in 2022 BEVs stood at 10%share (about 7.2 million) and PHEVs at 4% share (about 2.9 million). For the total year of 2023, it is possible that total EV sales could reach more than 13 million. In China, annual production of ternary precursors used to produce different types of nickel-containing batteries has been consistently rising, reaching 320kt in 2020, 634kt in 2021, and 843kt in 2022, according to MySteel. With regard to NCM batteries, high-nickel NCM811 and NCM622 precursors are becoming more favoured and represented 42% (21% in 2020 and 29% in 2021) and 28%(18% in 2020 and 24% in 2021) of NCM precursor production, respectively, in 2022. In the first 9 months of 2023, production increased +1.5%, with negative growth until April (-1.6%) – due to subsidy cuts and the peak of the pandemic in the country. September and provisional figures for October show a decline in the production.

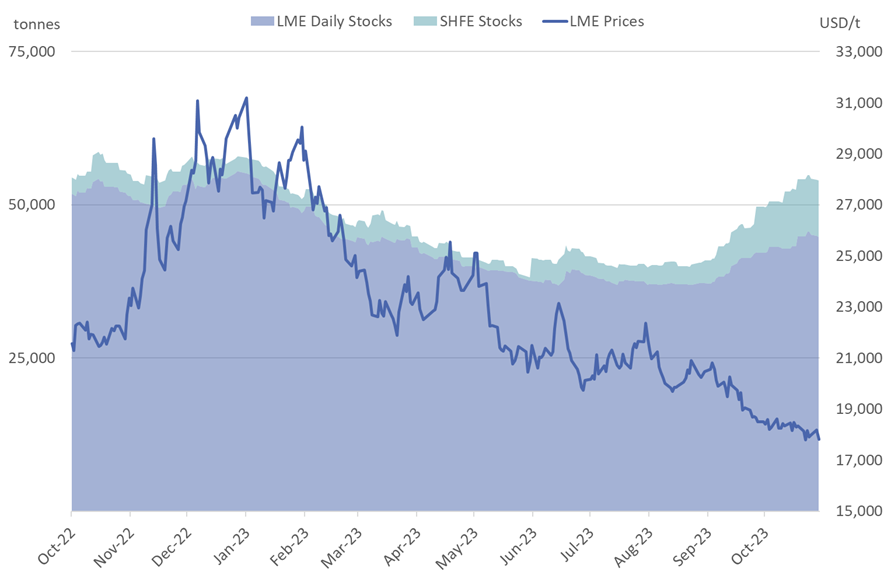

LME nickel prices and stocks

Nickel prices and stocks

Lastly, we will briefly analyse nickel prices and exchange stocks for the first 10 months of 2023.

Since the beginning of 2023, the London Metal Exchange (LME) nickel price (close, cash settlement) has been trending downwards. After starting the year at 31,200 USD/t, prices decreased to 21,895 USD/t in mid-March. This was followed by a recovery that ended on 20 April with a peak of 25,540 USD/t. Since then, a decreasing trend has become apparent. In mid-September prices fell below 20,000 USD/t for the first time since December 2021. During this period, peaks have been successively lower – 25,100 USD/t on 3 May, 23,140 USD/t on 16 June and 22,355 USD/t on 1 August (this latter spike matching Indonesia’s announcement of decisions to prevent nickel oversupply). Looking at monthly average prices, after a decrease of 3,383 USD/t in March 2023, the 3rd largest since 2010 (the two largest decreases were in the atypical year of 2022), April was the only month with an average monthly price increase (+450 USD/t). This coincided with reports of short covering and very low visible stocks. From May to October, coinciding with growing reports of the market being oversupplied, the rising possibility of converting class 2 to exchange deliverable class 1 nickel and new listings at the LME, average monthly nickel prices have been decreasing on average at about 900 USD/t each month, with a faster decrease seen in May (-1,527 USD/t) and a slower one in July (-295 USD/t).

After a more or less steady decrease from 270,000t since April 2021, followed by a slight increase in the fourth quarter of 2022, combined LME and Shanghai Futures Exchange (SHFE) nickel stocks started 2023 at a level of about 57,900t. Since the beginning of the year, destocking recommenced at an average pace of about 4,000t per month until end-May. 27 April marked the first time LME stocks had fallen below 40,000 t since 2007, and on 16 June the LME had its lowest nickel stocks level declined to 36,810t. At that time SHFE stocks were already recovering from the lowest value to ever be recorded since the contract was launched in 2015, 506t, in the last week of May. Combined exchange stocks hit a lowest point on 1 June (38,162t) and, apart from July, have been increasing every month, finishing October at 53,952t. Significantly, about 9,000t were added in September, 5,000t to LME and 4,000t to SHFE warehouses. LME end-of-month off-warrant stocks in August were 7,580t. A minimum level of 385t in May 2023, the lowest since this figure started to be published in February 2020, was followed by a sharp increase in June, to 6,587t. This was boosted by additions to European and US warehouses, whilst in Asia the figure remains under 100t.

About this Featured Story

This Featured Story appeared in Stainless Steel World December 2023 magazine. To read many more articles like these on an (almost) monthly basis, subscribe to our magazine (available in print and digital format) – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.