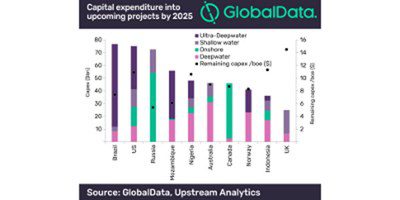

Over USD 811B will be spent on 615 upcoming oil and gas fields between 2018 and 2025. Globally, capital expenditure (capex) into conventional oil, heavy oil, oil sands and unconventional oil projects would add up to USD 352B, USD 44B, USD 43.4B and USD 30B respectively over the eight-year period, according to GlobalData.

Conventional gas projects will require USD 363.2B, while the investments into coal bed methane (CBM) and unconventional gas projects will total USD 3.7B and USD 1.6B in upstream capital expenditure by 2025.

Brazil accounts for USD 76.7B or over 9.5% of USD 811B of capex for the period of 2018 to 2025. Brazil has 49 announced and planned fields. The US follows with USD 75.0B or an approximate 9.3% share in global planned and announced capex over the forecast period. The country has 37 planned and announced fields.

Russia is expected to contribute USD 72.6B or around 9% to the total capex spending between 2018 and 2025. Russia has 49 planned and announced fields.

GlobalData expects that over their lifetime, the 615 upcoming oil and gas projects will require USD 1,705B in capex to produce over 88,033 million barrels of crude and 877,448 bcf of gas.