Article by Caio Pisano, Technical Marketing Development Manager, CBMM Europe

We all know that history has a way of repeating itself, and it’s no different in the dynamic world of stainless steel. As the global market evolves, steelmakers and end-users develop new materials and applications, making people’s lives easier and bringing new technological and commercial insights to the supply chain. However, understanding significant events from the past can be crucial to clear the way for developments in the future.

Nickel prices went through the roof on March 8, 2022, climbing above the unbelievable amount of USD 100,000 per ton, which led to the suspension in any trading activity in the London Metal Exchange (LME) for this material. After a few days, on March 16, 2022, LME tried to reimplement trading activities but suspended them again after a few minutes due to system errors, leading the market into a chaotic Wednesday.

If you’ve been in this industry for a while, you know that nickel volatility is nothing new and will recall a spike in prices in 2007, peaking above USD 54,000 per ton. On that occasion, prices peaked over a few months instead of a few days, as in the current situation. The world was also not facing major conflicts or a global pandemic. However, a few months after the nickel price peaked, the Global Financial Crisis (GFC) took place, proving the concept that the volatility is there and will be there in the future.

Raw material price volatility is bad news for stainless steel end-users who are exposed to increases in alloy surcharge prices. There are indications that the alloy surcharge for austenitic stainless steel will be higher in May 2022 than the total price of the same steel in February 2022. Therefore end users who didn’t forecast that the nickel prices would rise to these high levels could have issues in the coming months.

The questions to be answered in this article are: How can you protect yourself against nickel volatility, and how can we avoid falling global demand for stainless steel due to prohibitive prices? We can look to the past for interesting insights to answer these questions. In the years following the price spike in 2007, we see significant growth in the share of ferritic stainless steels (nickel free). It’s also possible to see the development of new solutions, such as Mn-austenitic stainless steels (200 Series), for applications that didn’t have significant technical requirements although this grade still contains low levels of nickel.

A few years later, niobium stabilized ferritic stainless steels started to gain market share. These materials could be easily welded and used in some high-temperature applications where austenitic stainless steels were specified. In some specific cases, they could be deep drawn, opening the door for their usage in the white goods industry. A significant example was the development of 430Nb for deep drawing quality, with an enhanced crystallographic texture. This material is now used in sinks, stovetops and other white goods applications.

A few years later, niobium stabilized ferritic stainless steels started to gain market share. These materials could be easily welded and used in some high-temperature applications where austenitic stainless steels were specified. In some specific cases, they could be deep drawn, opening the door for their usage in the white goods industry. A significant example was the development of 430Nb for deep drawing quality, with an enhanced crystallographic texture. This material is now used in sinks, stovetops and other white goods applications.

After a significant movement from austenitics to ferritics, nickel prices stabilized and new developments again began to consider austenitics as a solution. The share of ferritic grades last year was around 20% compared to other grades. Today’s situation is even more extreme due to the price levels and the speed at which they got there. We can already see a second significant movement from the industry in considering the migration from austenitic to ferritic stainless steel. There is a risk that if stainless prices reach prohibitive levels, there could be a catastrophic migration of part of the demand to other materials, such as aluminum or coated carbon steels. Once this migration has taken place, the recovery mentioned in the paragraph above will most likely not happen.

Well-prepared manufacturers & end-users

From the technical and metallurgical perspective, stainless manufacturers are better prepared for the situation today, since ferritic stainless steel production has evolved significantly in the past few years. The main regions of the globe are well prepared to produce high quality stabilized ferritic materials that can be used in many applications and segments. From the application perspective, it’s also possible to say that end-users of stainless steels are better prepared for this migration. Eventual adjustments in manufacturing processes such as welding parameters and stamping process design, can be done agilely.

Another major technical aspect to consider is the materials’ corrosion performance and surface quality. Ferritic grades have evolved so much that some perform better than the classical AISI 304/AISI 304L. Therefore, implementing this modification could be done quickly and effectively without compromising the performance of many products. One major example is the elevator industry which has already migrated a significant percentage of its components, while most panels are already specified in ferritic materials.

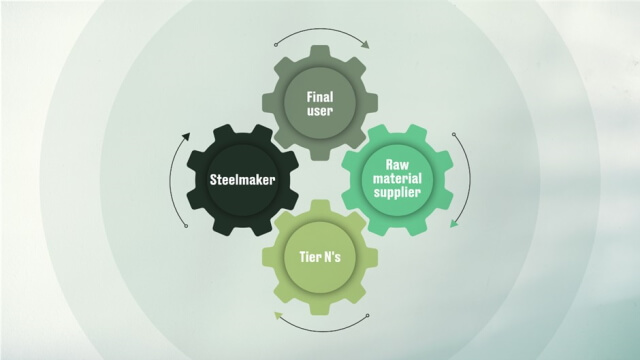

Some industry segments are already implementing high technological niobium stabilized ferritic grades as the main solution for applications, such as the hydrogen and mobility industries. However, rapid implementation cannot be achieved without considerable synergy in the supply chain. The development of materials must consider the final application so the steel plant can define the metallurgical targets (microstructure, crystallographic texture, surface quality and so on), and the end-users can define the required performance for the specific applications, validating and implementing the modifications. The faster this synergy happens, the more protected the stainless steel market will be from reduced demand.

To summarize, the stainless industry will once again have to be dynamic and resistant to the corrosivity of the environment in which we are currently living. I’m sure that when we look back at this moment in a few years, the material mix in the stainless world may be different, but one thing which will not have changed is the volatility of nickel pricing and the risk that materials can bring to stainless demand.