Article by Ricardo Ferreira, INSG Director of Market Research and Statistics, Meng Jianbin, INSG Director of Economics and Environment & Francisco Pinto, INSG Manager of Statistical Analysis

___

Production

PT Antam also increased production marginally in 2017 and announced further increases this year. Regarding nickel ore exports, the Indonesian government announced on 12 January 2017 a relaxation of the raw materials export ban imposed at the beginning of 2014. Subject to licenses issued by the government, producers will be allowed to export ore if they complete smelter projects within 5 years and dedicate at least 30% of capacity to processing low-grade ore (up to 1.7%). From an initial level of 5.2 Mt of nickel ore exports a year, approved quotas have reached 32 Mt so far, with requests for approval for an additional 4 Mt.

Hence companies allowed to export will get additional funding for the development of projects. Chinese NPI producers will have more feed available and INSG expects combined NPI production in China and in Indonesia to increase to around 720,000 tonnes in 2018. On 2 February 2017 the Filipino government announced the final results of an environmental audit of mines that had been taking place since mid-2016; however, in the meantime Ms. Regina Lopez was replaced by Mr. Roy Cimatu in October as Minister of Environment and Natural Resources. The newly appointed Minister said his department intended to conclude a second review of mining operations by the end of the last year, covering all operating mines, including those previously ordered to be closed or suspended.

This review has now been postponed to mid-2018. Elsewhere we have seen production adjustments being implemented. In Africa, nickel production increased in South Africa in 2016 and 2017 but is likely to decrease in 2018. In Madagascar, Ambatovy failed to ramp-up production in 2016 and 2017 but it is possible that it could rise in 2018. Both Botswana and Zimbabwe are currently not producing.

In Europe, Russian Nornickel restructured operations in order to optimize them and to reduce environmental impacts. This included transferring part of the production to Harjavalta in Finland. Also in Russia, Ufaleynickel closed its ferronickel plant but there is speculation that Buruktahl could reopen. Finland’s Terrafame revived its Talvivaara operation and announced a strategy focused on producing battery materials. France’s Eramet stopped receiving feed from New Caledonia and will instead source it from Finland.

In FYRO Macedonia, FeNi Industries stopped production in Q3 2017 but could restart this year after securing financial support. In Oceania, Australian producer BHP is building a unit next to its refinery to produce nickel sulphate for the battery sector. In March 2016 the Yabulu refinery stopped operating. In New Caledonia, Vale is still re-evaluating the Goro operation. This includes the possibility of selling it according to recent announcements. Several large nickel producers have announced that they will increase their focus on producing materials for batteries for electric vehicles.

Nickel usage

According to a preliminary forecast from ISSF, world stainless steel apparent consumption will grow around 5% in 2018. Tsingshan announced that it commenced producing stainless steel in Indonesia in July 2017 and are currently ramping up production. Nickel-rich 300 series stainless steel production remained at a high level, especially in China, which is beneficial for growth in primary nickel demand. Stainless steel scrap availability is expected to continue to improve due to higher prices. According to the recently completed report “The Use of Nickel in Batteries 2018” commissioned by the INSG, the use of nickel in batteries is a major focus regarding the development of new projects.

With the intensified emphasis put on vehicle hybridization and electrification by governments across the world, all major car makers have been responding to this trend by announcing timetables for their new hybrid or electric models and, in some cases, even a complete transition to a fully electrified fleet. We will summarise some of the key findings from this report. As a key material for batteries, the global output of nickel sulphate reached 69,000 tonnes (all quantities hereinafter are in nickel content) in 2017 and is expected to reach 101,000 tonnes by 2021.

Chinese enterprises, such as Jinchuan Group, intend to reduce electrolytic nickel production and to expand the output of nickel sulphate. Other private companies, such as Tianjin Maolian and Yantai Kaishi, also plan to change their electrolytic nickel capacity to nickel sulphate.

Raw materials to produce nickel sulphate mainly include nickel matte, nickel intermediate and crude nickel sulphate from copper/PGM refineries. Nickel intermediate products include nickel intermediates from the hydrometallurgical process, mixed NiCo sulfide (with Ni + Co content 35%) and others. The total output of nickel intermediate reached 156,000 tonnes in 2017, and it is expected that output of nickel intermediate will reach 193,000 tonnes by 2021. Due to the limited availability of raw materials to produce nickel sulphate, some producers in China have started using nickel briquettes despite the fact that the cost is higher than using intermediate nickel.

In South Africa, Thakadu Battery Materials will invest in a nickel sulphate plant with an installed capacity of 31,000 tonnes of high-purity battery-grade nickel sulphate from the crude nickel sulphate stream of PGM producers. Nickel usage in batteries includes nickel foam, spherical nickel and hydrogen storage alloys in NiMH batteries, and ternary materials in Li-ion batteries.

Nickel foam and hydrogen storage alloys are mainly used in NiMH batteries; spherical nickel hydroxide is mainly used as cathode material for NiCd and NiMH batteries; ternary materials like NCM/ NCA are used in producing cathode for lithium-ion batteries. NCM/NCA can not only be used in EV batteries, but also in 3C products’ batteries in order to reduce costs. In 2017, global output of NCM/NCA was about 185,000 tonnes which used 62,000 tonnes of nickel – of which 54,000 tonnes was primary nickel and the rest sourced from nickel scrap. It is expected that in 2021, global NCM/NCA output will reach 470,000 tonnes and will use 230,000 tonnes of nickel – 186,000 tonnes from primary nickel and 44,000 tonnes from nickel scrap.

Global primary nickel usage in NCM/NCA will see a 36.2% of CAGR for the 2017-2021period. Propelled by the electric vehicle industry, it is anticipated that nickel usage in batteries will account for 8% of total nickel usage by the year 2021 compared to 3.6% last year. The global battery industry used 80,900 tonnes nickel in 2017, including 4,200 tonnes from scrap, and the volume is expected to reach 240,500 tonnes, including 26,300 tonnes scrap by 2021. The CAGR from 2017-2021 will be 31.3%.

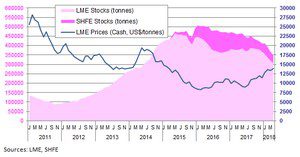

Stocks and prices

This distribution is very similar to what it was in the end of 2017, suggesting similar stock drawdowns in relative terms over this period, though the SHFE saw a large increase in stocks in January (12,500 tonnes) that was then compensated by larger than usual withdrawals over the following months.