Article by Ricardo Ferreira, INSG Director of Market Research and Statistics and Jianbin Meng, INSG Director of Economics and Environment.

_____

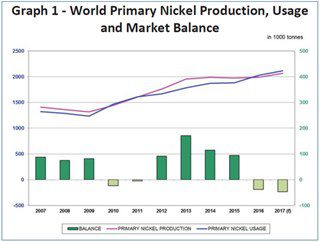

The nickel market accumulated a surplus of almost 690,000 tonnes from 2007 and 2015, but entered in deficit in 2016 and it is expected to continue in deficit in 2017. INSG forecasts 2.07 Mt for production and 2.11 Mt for usage in 2017, leaving the nickel market with a deficit of almost 47,000 tonnes.

Source: INSG

Production

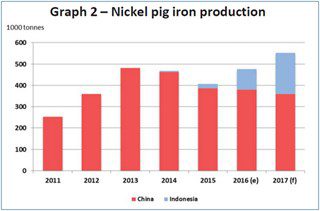

In 2016 total primary nickel production grew marginally (+0.7%) due to the combined reduction of Chinese nickel pig iron (NPI) production and lower output from traditional producers, but compensated by the ramp up of new NPI projects in Indonesia, mainly financed by Chinese companies. Total primary output was 1.976 Mt in 2015, and increased to an estimated 1.989 Mt in 2016. The Indonesian ban on nickel ore export and the low nickel price level has led to a reduction of NPI production in China from almost 470 kt in 2014, down to around 380 kt in 2016.

Furthermore, the Chinese government has reportedly moved to close several NPI plants due to the adoption of stricter environmental legislation. Since January 2014 the Philippines has been virtually the sole supplier of nickel ore to the Chinese NPI producers. The country exported 25.4 Mt of nickel ore in gross weight to China in 2015, mainly middle and low grades, and 27.1 Mt in 2016. This year, on 12 January, Indonesia announced a relaxation of the raw materials export ban imposed in the beginning of 2014, affecting nickel and bauxite, and, on 2 February, the Philippines announced the final results of an environmental audit that had been taking place since mid-2016.

The Indonesian Government imposed conditions for miners to export nickel ore: they must dedicate at least 30% of their smelter capacity to process lowgrade ore (up to 1.7%) and also they must show progress in the construction of their smelter. With this change, the Minister of Energy and Mineral Resources said that the country may export up to 5.2 million tonnes of nickel ore a year.

As a consequence, more material will available to the market, especially for NPI producers in China, and the companies allowed to export will get additional funding for the development of their new projects. In the Philippines, Ms. Regina Lopez, then Minister of Environment and Natural Resources, ordered a comprehensive review of the Philippines’ mining industry. The final results of this audit meant that two nickel mines were suspended and 17 were closed. The affected mines filed appeals to the President. Meanwhile, in the beginning of May, a finance official said the Philippine government will have a second review of the country’s mines, covering all 41 mines operating in the country, including the 26 previously ordered closed or suspended.

While the combined effect of these two political decisions on the market is still very difficult to evaluate, NPI production in China is expected to decrease marginally in 2017 compared to 2016. Meanwhile, NPI production in Indonesia has increased considerably from an estimated 21 kt in 2015 up to more than 90 kt kt in 2016. For 2017 a further increase is expected up to around 190 kt due to the completion of the expansion at the Tsingshan plant and the commissioning of a number of other smaller projects.

Elsewhere cuts in production have been implemented by the Brazilian producer Votorantim at its Tocantins (Niquelândia) nickel mine and process plant, and by the Yabulu refinery in Australia which stopped operation in March 2016 and seems unlikely to reopen in the foreseeable future. Production at Loma de Níquel in Venezuela ceased in the third quarter 2015. Reduced production has also been recorded in Europe namely in Macedonia and Serbia. The Loma Miranda nickel mine and the Falcondo ferronickel plant in Dominican Republic have restarted production in 2016 under the ownership of the company Americano Nickel. BCL smelter in Botswana was closed. In Zimbabwe, both plants were closed – Bindura refinery is currently being refurbished, and the owner of the Empress refinery is looking for an investment partner. Recently, Ufaleynickel in the Russian Federation announced the closure of its ferronickel plant.

Sources: ISSF, Antaike, INSG estimates

Usage

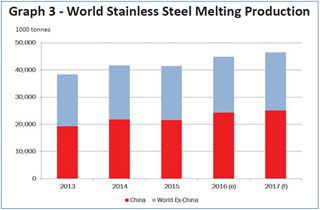

2016 saw a recovery for all metals supported by better economic conditions worldwide. Stainless steel production took part in this recovery. According to the International Stainless Steel Forum (ISSF), world stainless steel melting production recorded a 10.2% increase during 2016, after reaching 41.5 Mt in 2015. China recorded an impressive 15.7% growth rebounding from the 0.6% decrease in 2015, driven by strong domestic demand and sustained exports mainly to other Asian countries. Low nickel prices, which led to less availability of stainless scrap (especially in Europe and the United States), in combination with increased NPI prices, encouraged stainless steel producers to use more primary nickel which was manifested by the strong expansion in S300 production in China with a 13.5% y-o-y increase.

In the non-stainless sectors the demand for primary nickel remained stable overall with the aerospace and battery sectors continuing to show a positive trend in 2016 which is expected to continue in 2017. In 2017, according to a preliminary forecast, world stainless steel melting production will grow by 3.5%. In Europe, stainless steel production will increase by 2% with European producers still benefiting from the EU action on antidumping measures against Chinese stainless steel cold rolled coil imports to Europe.

In the United States, good market conditions in the main end-use sectors (building/construction, automotive and household appliances) will underpin an increase in stainless steel production of around 3%. In China stainless steel production should increase in 2017, although at a lower rate than in 2016, as the country is expected to cut excessive capacity. For India, the forecast is for growth of around 7% in stainless steel production continuing to benefit from the Indian government´s efforts to improve the country’s infrastructure and the “Make in India” program. Indonesia is expected to start stainless steel production in the second half of 2017.

Expectations for nickel-rich 300 series stainless steel production to remain at a high level, especially in China, will be beneficial for further growth in primary nickel demand. Stainless steel scrap availability is also expected to continue to improve this year after the decline experienced in 2016. Total nickel global usage in 2016 was estimated at 2.027 Mt, an increase of 7.7% over 2015. Asia saw an increase of 9.6% with strong growth recorded in China and India, 11.2% and 11.5% respectively. Africa reported an increase of 18.3% thanks to the increase in stainless steel production in South Africa, while a more limited increase was noted in Europe (+1.3%) and the Americas (+4.3%). In terms of volume, by far the largest using country is China, with 1.087 Mt. As mentioned, INSG forecasts 2.11 Mt for usage in 2017, leaving the nickel market with a deficit of almost 47,000 tonnes, considering the forecast of 2.07 Mt for production.

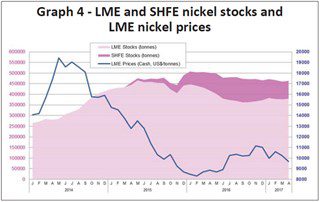

Stocks and prices

Stocks remain high both at London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE) warehouses, reaching by the end of April 2017 a combined total of more than 460,000 tonnes. The SHFE launched a nickel contract in March 2015 and stocks grew to be at a level of more than 100,000 tonnes for much of the second half of 2016, but have decreased to around 80,000 tonnes in the first four months of 2017. The LME nickel price has increased from U$/t 8,515 in the beginning of January 2016 to U$/t 10,010 in December 2016. After the announcement of the easing of the Indonesian ban in January 2017, the nickel price decreased but recovered in February when the results of the mine audit in the Philippines were released. From March to early May the price decreased from U$/t 11,000 to a level of less than U$/t 9,300.

INSG Meetings

During discussions at the April 2017 INSG meetings, China, the world’s largest nickel producer and user, was the focus of considerable attention. The response of the Chinese nickel pig iron (NPI) industry to the various possible outcomes of the Filipino’s Government review of the mining industry was analyzed – the potential closure of a number of nickel mines could have a negative impact on the future production of NPI in China. However, the decision taken by the Indonesian Government to relax the ban on the export of nickel should benefit NPI producers in China providing a lifeline to maintain the levels of production reached in recent years. The expectation of a lower growth rate in China along with its efforts in shifting towards a service and consumption driven growth model from an infrastructure and investment-intensive model will put downward pressure on stainless production and demand.