A storage tank for hydrogen peroxide. Attribution: Col André Kritzinger, used under a Creative Commons license via Wikimedia.org

The market for a key industrial chemical is set to grow, according to a recent report by Global Market Insights. They valued the hydrogen peroxide (H2O2) market size at around USD 4.8 billion in 2019 and forecast a growth rate of over 5.7% CAGR from the period of 2020 to 2026. Major factors driving this progression include the growing demand worldwide for pulp & paper plus increased propylene oxide production. The outlook for growth seems especially strong in India.

By David Sear

Background

Information about suitable materials when working with hydrogen peroxide can be readily found via the websites of chemical companies involved in its manufacture. For example, a product information manual issued by Nouryon gives information on designing equipment to contain hydrogen peroxide. Their starting point is the observation that hydrogen peroxide reacts easily with many metals such as iron, copper, etc, causing catalytic decomposition of the hydrogen peroxide. This rules out the use of a vast number of metals. Fortunately, very pure, passivated stainless steel and pure aluminum do not have this effect and can therefore be used as construction materials for tanks and piping etc. Nevertheless, Nouryon later state that stainless steel is the most suitable material for hydrogen peroxide equipment. Their manual further recommends that instruments, piping, pumps, valves, fittings and the like should be made of stainless steel equivalent to grade AISI 316L (EN 1.4404). This material can apparently also be used for tanks and mixing vessels.

Nouryon also provide notes on fabrication techniques. For example, whenever possible, TIG welding with shielding gas should be used. A properly executed TIG-welded pipe joint does not need to be pickled on the inside. Cleaning with water and passivation with hydrogen peroxide is sufficient. If pickling is deemed necessary for the piping nitric acid must be used. Tanks, which cannot be filled with shielding gas, are usually welded using the metal arc welding method. It is important that the filler rod is of the same composition as the parent material. When the slag has been removed the weld should be cleaned with a rotating wire brush (of austenitic stainless steel) and treated with pickle paste. The pickle paste is removed with a hard plastic brush and water. Stainless steel tanks must be cleaned and pickled before final passivation with hydrogen peroxide and/or nitric acid.

“NPL has developed detailed engineering codes and specifications covering the fabrication of storage equipment for hydrogen peroxide.”

Thirty-year lifespan

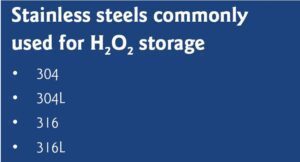

The messages from Nouryon are reinforced by Solvay’s technical data sheet. They indicate that three primary materials of construction are recommended for the storage of hydrogen peroxide; low-carbon stainless steel, high-purity aluminum, and high-density polyethylene. Recognizing that each has its own advantages and disadvantages, they add that low-carbon grades of stainless steel are excellent for the storage of hydrogen peroxide. Alloys which are suitable include 304, 304L, 316 and 316L. Properly passivated stainless steel provides a very stable surface for the storage of hydrogen peroxide. As the corrosivity of hydrogen peroxide on stainless steel is minimal, a typical tank should last thirty years or more, according to Solvay.

The observations given above about materials suited for hydrogen peroxide are also mirrored by the website of Indian company National Peroxide Limited (NPL). For example, they indicate that the selection of construction materials for equipment to be used in service with commercial solutions of hydrogen peroxide must be undertaken with care to avoid decomposition problems. These restrictions do not necessarily apply to end-uses, where contact times are short and the solution may be quite dilute and a safe method has been established. Suitable materials for service with hydrogen peroxide are: aluminium of 99.5% minimum purity; fully austenitic stainless steels like 304; plastics like high density polyethylene; glass. It is also worthy to note that NPL has developed detailed engineering codes and specifications covering the fabrication of storage equipment for hydrogen peroxide, and that advice and assistance is available on request.

NPL sees opportunities ahead for H2O2

The future looks promising for the hydrogen peroxide industry in India. At least, that is the deduction from reading NPL’s Annual Report 2019-2020. Under the section covering opportunities and threats, they foresee the following prospects based on developments in the user industries.

Pulp and Paper: the Indian paper industry is reported to be the fastest growing paper market among large economies. Insider estimates slate overall paper demand to grow at Compound Annual Growth Rate (CAGR) of 5-6% after reaching about 20 million tonnes in 2019-20. India is said to be the fastest growing market for paper globally which presents an exciting scenario. Particularly encouraging signals can be seen in the packaging board segment with increasing demand from the e-commerce industry. However due to impact of the COVID-19 pandemic, the demand of paper and boards in India in 2020-21 is likely to be negatively affected for some time.

Textiles: the Indian textile and apparel market is estimated to be growing at CAGR of 8.7% and expected to touch USD 226 Billion by 2023. Growth in domestic textile industry and Government of India’s focus to further develop this sector augurs well for the demand of hydrogen peroxide in India. However, due to COVID-19 pandemic, the demand from domestic and export markets in the textile industry is likely to be impacted.

Oil refining: demand for hydrogen peroxide from oil refineries for effluent treatment has been developing and will continue to grow with increase in the volume of crude oil being processed by  existing and upcoming refineries in the country. India needs to double its oil refining capacity by 2040 to meet the ever-increasing demand. Substantial investments planned in this segment both by private and public sector will boost the demand of hydrogen peroxide for refineries.

existing and upcoming refineries in the country. India needs to double its oil refining capacity by 2040 to meet the ever-increasing demand. Substantial investments planned in this segment both by private and public sector will boost the demand of hydrogen peroxide for refineries.

Disinfection: the market size has exploded and increased manifold with the present COVID situation. It is expected that the market size would continue to expand as hygiene improvement would be one of the main drivers that would drive the size of the market in future. This offers a new and developing market to hydrogen peroxide due to its ability to kill bacteria, virus and fungus.

Based on the indicators above, it comes as no surprise to learn that NPL recently completed the expansion of hydrogen peroxide production capacity from 95,000 MT per annum (50% w/w) to 150,000 MT per annum (50% w/w). This, according to the Annual Report, makes NPL now the largest producer of hydrogen peroxide in the country.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.

Featured Story by: David Sear

All images were taken before the COVID-19 pandemic, or in compliance with social distancing.