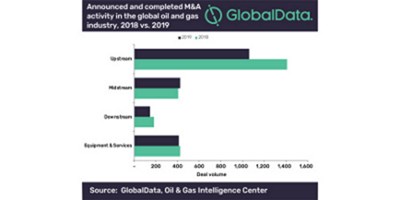

The upstream sector accounted for the bulk of mergers and acquisitions (M&A) in the global oil and gas industry in 2019, generating some high-value transactions during the process. The acquisition of Anadarko Petroleum by Occidental Petroleum in April 2019 for a purchase consideration of USD 57bn was the highlight of oil and gas M&A activity last year.

The company’s theme report, ‘M&A in Oil and Gas – 2020’, analyses deal activity in the oil & gas industry in 2019 and identifies key trends emerging from these deals.

The oil sands deposits of Alberta and Saskatchewan in Canada also featured in deal activity in 2019 as companies divested their assets to Canadian operators amid infrastructure and environmental concerns. In one such transaction, US-based Devon Energy sold its oil sands assets to Canadian Natural Resources to focus on operations in the US.

The midstream and downstream sectors also witnessed notable deals in 2019, particularly for pipeline assets in key oil and gas producing regions around the world. Petrobras, Marathon Petroleum, Saudi Aramco, and Total were among the companies executing high-value deals in midstream and downstream sectors in 2019.