Government and industry representatives met on the 22nd and 23rd April 2025 for the most recent International Nickel Study Group meetings during which the Group reviewed its forecasts for nickel production and use for 2025. This article gives a brief overview of recent developments and is based on the data finalized at the meetings.

By Ricardo Ferreira, INSG Director of Market Research and Statistics & Francisco Pinto, INSG Manager of Statistical Analysis

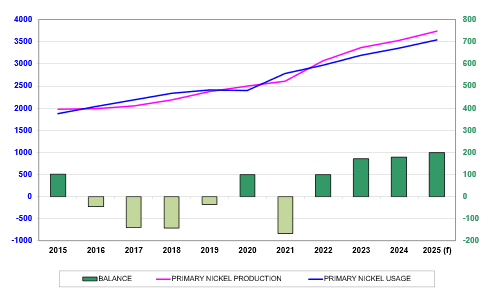

The global economy is currently undergoing shifts in national policies, particularly in relation to trade, which are likely to heighten uncertainty across raw materials markets. At its April 2025 meetings, the International Nickel Study Group (INSG) updated its forecasts for the world nickel market, reporting a surplus of 179 thousand tonnes (kt) for 2024. Primary nickel production for the year is estimated at 3.526 million tonnes (Mt), while usage stood at 3.347Mt. Looking ahead to 2025, preliminary figures point to an even larger surplus of 198kt, with output projected to increase to 3.735Mt and demand forecast to reach 3.537Mt.

Primary nickel production

In 2025, global primary nickel production is projected to grow by 5.9%, following increases of 9.8% in 2023 and 4.8% in 2024.

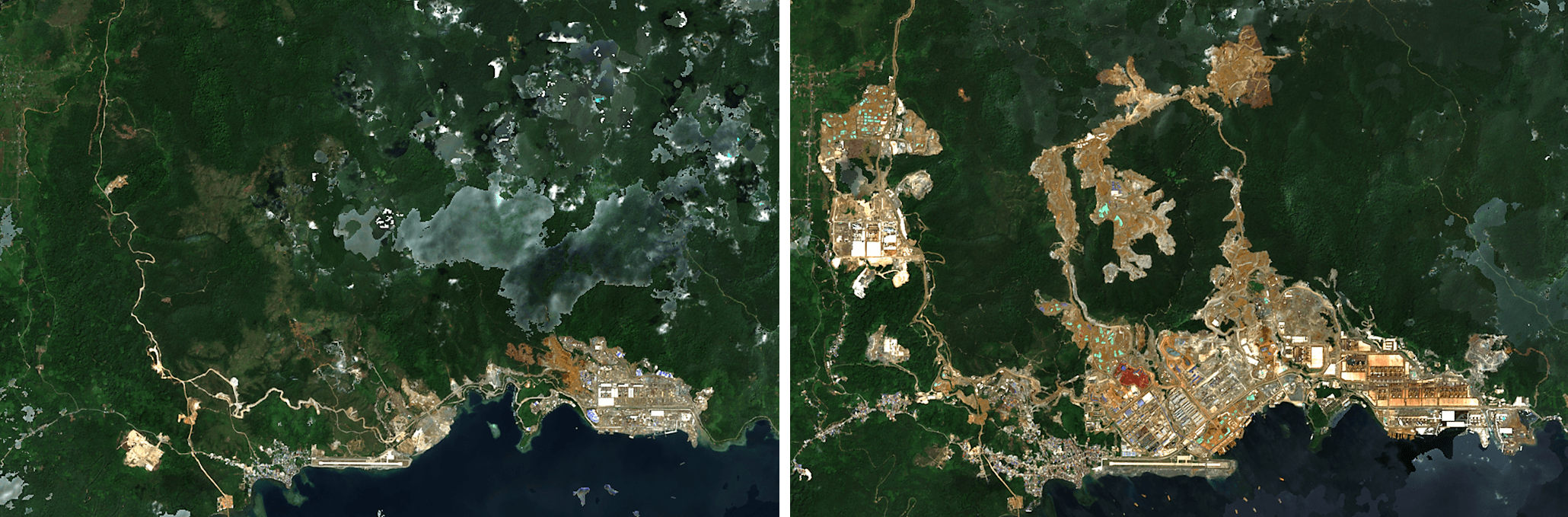

Asia’s primary nickel production reached 2.842 million tonnes (Mt) in 2024, marking a 9.5% rise, and is forecast to climb to 3.056Mt in 2025 (+7.5%). Indonesia is set to increase output from 1.609Mt to 1.750Mt, thereby consolidating its position as the world’s leading producer, followed by China with respective volumes of 1.029Mt and 1.095Mt. Both countries are expected to expand their production of nickel sulphate and cathode this year. Combined Chinese and Indonesian nickel pig iron (NPI) production is estimated at 1.85Mt in 2024 and is forecast to rise to 1.935Mt in 2025. While China’s NPI output has been in decline since 2019, Indonesia has significantly ramped up production over the past decade. However, the Indonesian government has delayed

the issuance of mining quotas, resulting in supply shortages; as a consequence, some producers have resorted to importing ore from the Philippines to maintain NPI production levels.

Furthermore, discussions took place in Indonesia regarding potential restrictions on new licenses for NPI capacity. At the same time, Indonesian NPI has been exported to European stainless steel (STS) mills for testing as a potential feedstock. All other regions recorded a decline in primary nickel production in 2024, largely as a result of reduced profitability stemming from low nickel prices. In 2025, only Oceania is expected to experience a further contraction of 33.2%, driven by the suspension of BHP’s operations in Australia. Prony Resources resumed operations at its Goro plant in New Caledonia (France) last November, following a six-month suspension due to local unrest. The company produces nickel hydroxide cake (NHC), an intermediate nickel product primarily used in battery manufacturing. European production fell by 0.7% in 2024 but is forecast to recover modestly, with a 3.2% increase in 2025. In the Americas, output contracted by 10.5% in 2024, yet a rebound of 9.6% is anticipated in 2025, supported by rising production in Brazil and Canada. African production declined by 4.9% in 2024 but is expected to grow by 2.5% in the coming year.

Indonesia Weda Bay Industrial Park and surrounding area, 2020 and 2025

Primary nickel usage

Global nickel usage has grown steadily since 2009, with the sole exception of 2020, when it declined by 0.6%. In 2024, usage rose by 4.8% and is forecast to grow by a further 5.7% in 2025, with China remaining the principal contributor in absolute terms in both years.

Asia accounted for 86.8% of global primary nickel usage in 2024, a share expected to rise slightly to 86.9% in 2025. Demand in China increased by 4.3% in 2024 and is forecast to expand by a further 5.8% in 2025. China is the world’s largest consuming market and is projected to account for 63.4% and 63.5% of global primary nickel usage in 2024 and 2025, respectively. Chinese demand continues to be driven primarily by the STS sector, although the influence of the battery segment is growing, albeit at a slower pace than previously anticipated. Indonesia, which began producing stainless steel in 2017, became the world’s second-largest nickel user in 2020, when consumption reached 210kt, overtaking Japan. Demand surged in 2021 to 383kt but declined in 2022 and 2023 due to import restrictions on stainless steel imposed by several countries.

However, consumption rebounded in 2024 to nearly 400kt and is projected to rise again in 2025 by 8.6%. The country is also developing its downstream battery and electric vehicle industries, which is expected to lead to increased domestic nickel usage.

Following declines in 2023 and 2024, European nickel usage is expected to recover in 2025, with a projected increase of 3.5%. The previous years’ performance was affected by economic challenges and industrial action at several European stainless steel facilities.

In the Americas, nickel usage grew by 1.7% in 2024 and is forecast to rise by 3.3% in 2025, with the United States contributing a 0.5% increase in 2024 and a further 3.6% in 2025.

In Africa, demand declined sharply in 2023 (-26.6%) but rebounded strongly in 2024 (+25.0%) and is projected to surge by 67.0% in 2025. The start-up of a new battery plant in Morocco in early 2025 is expected to significantly boost regional nickel consumption.

The STS sector remains the most significant first-use market for primary nickel, although its share has been gradually declining since peaking in 2020, owing to the rising demand for nickel in electric vehicles (EVs). Currently, just under 70% of primary nickel is used in the STS sector. The growing requirement for nickel in the production of lithium-ion batteries is expected to lead to an increasing share of demand from this segment in the coming years.

According to worldstainless (formerly the International Stainless Steel Forum, ISSF), global “stainless steel melt shop production increased by 7% from 2023 to 2024 to a total of 62.6 million metric tonnes”. A slower rate of growth is anticipated for 2025.

Nickel usage in batteries for EVs has continued to rise, though at a slower pace than previously expected. This weaker growth has been attributed to the withdrawal of government subsidies, competition from non-nickel chemistries – particularly lithium iron phosphate (LFP) – and a recent shift in consumer preference towards plug-in hybrid electric vehicles (PHEVs) over battery electric vehicles (BEVs). Nonetheless, demand for nickel in this sector remains on an upward trend.

According to Mysteel, annual Chinese production of ternary precursors – used in the manufacture of various nickel-containing batteries – rose steadily until 2022, reaching 320kt in 2020, 634kt in 2021 (+98%), and 843kt in 2022 (+33%). However, output declined to 793kt in 2023 (-5.9%) and further to 782kt in 2024 (-1.3%). Provisional data for the first quarter of 2025 suggests a recovery, with production increasing by 14%.

Among the precursor types, NCM622 gained market share in 2024, accounting for 32% of total output – up from 18% in 2020, 24% in 2021, 28% in 2022, and 31% in 2023. The share of higher-nickel NCM811, which had dropped to 38% in 2023, rebounded to nearly 40% in 2024. Over the opening two months of 2025, NCM622’s share rose further to 36%, while NCM811’s proportion edged down to below 37%.

In Europe, investment in battery manufacturing plants has encountered a number of challenges, including slower growth in electric vehicle demand, financing difficulties, and heightened competition from Asian producers. Several planned investments have recently been scaled back, delayed, or cancelled. Furthermore, the region’s increasing emphasis on LFP batteries – which do not contain nickel – has weighed on nickel demand in the battery sector.

Policy-driven shifts in the nickel market

In recent years, national policies have played an increasingly influential role in reshaping the global nickel market. Governments across key producing and consuming regions have introduced regulatory measures, trade restrictions, and investment incentives that have modified supply chains and altered market dynamics.

Indonesia’s policy framework has had a particularly significant impact on the global nickel sector. By banning the export of unprocessed ore, the government has aimed to promote domestic value addition by attracting investment in refining and in downstream industries such as STS and battery production. The introduction of the mining quota approval system (RKAB) has further tightened control over production volumes, influencing supply dynamics. Recent revisions to the royalty structure – including differentiated rates based on processing levels – are intended to enhance industry governance and improve the long-term management of the country’s nickel reserves. These revised royalties are expected to raise production costs. China’s policies, both at the national and international level, have had a considerable impact on the global nickel market. Domestically, the Chinese government has prioritised securing domestic nickel production and broader access to critical raw materials, alongside advancing the development of downstream industries. It has supported the growth of the EV industry, battery sector, and recycling through a combination of coordinated industrial and environmental policies, technological innovation, and sustained support for the domestic automotive sector. Ambitious targets for EV adoption and emissions reduction have also been set. Battery recycling is expanding, driven by both environmental goals and the need to strengthen resource security. Internationally, China has actively worked to secure nickel resources and expand its presence across the value chain.

Chinese firms have invested in overseas mining and refining – particularly in Indonesia –establishing integrated hubs for nickel, stainless steel, and battery material production. These investments reduce dependence on external suppliers and reinforce China’s strategic position in the global nickel market.

In February 2025, the Philippines introduced a bill to ban raw nickel ore exports, aiming to capture greater economic benefit from its mineral resources through domestic value-added processing. The move seeks to replicate neighbouring Indonesia’s success in developing its downstream nickel industry. However, industry stakeholders argue that the country may lack the infrastructure, affordable energy, and regulatory stability needed to support a competitive domestic processing sector, and that unless these fundamental challenges are addressed, the ban could result in mine closures, job losses, and reduced government revenues.

Both the European Union (EU) and the United States (US) are becoming increasingly active in securing critical raw materials and promoting sustainable industrial development. These efforts aim to reduce dependency on external suppliers, strengthen supply chain resilience, and encourage investment in domestic refining and recycling capacity. Growing emphasis is also being placed on environmental and social governance (ESG) standards, which may influence trade flows and sourcing decisions.

In the EU, the Critical Raw Materials Act and related strategies highlight the importance of nickel – 12 projects have been designated as strategic. These projects will benefit from coordinated support by the European Commission, Member States, and financial institutions, particularly in gaining access to financing and establishing links with relevant off-takers. They will also be subject to streamlined permitting procedures, with clear timelines: no more than 27 months for extraction projects and 15 months for processing or recycling initiatives (compared to current permitting durations of five to ten years). While expediting approvals, the process will continue to uphold ESG standards.

Also in the EU, the Carbon Border Adjustment Mechanism (CBAM), set to begin its transitional phase in 2026, will impose a carbon cost on imports of emissions-intensive products. It aims to prevent carbon leakage by ensuring that the carbon price of imports matches that of domestic production. This may raise costs for exporters with high-carbon production and limited emissions tracking, while encouraging cleaner processes and potentially shifting trade flows toward lower-carbon suppliers.

In the US, the Inflation Reduction Act and broader industrial policy frameworks support the development of local supply chains for strategic materials, including nickel. Last April, the US administration issued an executive order to expedite permits for deep-sea mining in both US and international waters, aiming to improve access to critical minerals such as nickel, cobalt, and copper. The move is intended to reduce reliance on foreign sources and has prompted debate over its environmental and legal implications.

Nickel prices and stocks

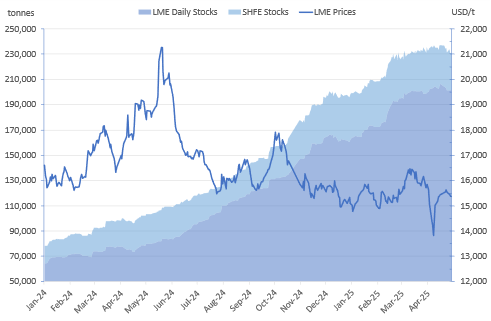

Lastly, we will briefly analyse nickel prices and exchange stocks from the beginning of 2024 until end-April 2025. The London Metal Exchange (LME) nickel price (close, cash seller) was 16,300 USD/t at the start of 2024. During the year, prices were volatile reaching a peak at 21,275 USD/t in late May, before falling sharply to a four-year low of 15,470 USD/t by the end of July. A partial recovery followed, to 17,920 USD/t on 3 October. Prices descended again in the last quarter, closing the year at 15,100 USD/t – down 9% from the start of the year. This decline coincided with downward revisions to short-term estimates and forecasts of nickel usage in batteries by analysts, reports of an oversupplied STS market, and scepticism about the efficacy of Chinese stimulus measures.

It also occurred amid large inflows of Chinese and Indonesian nickel intoLME warehouses. These developments came despite record-high EV sales and rising STS production. Between January and end-March 2025, LME nickel prices fluctuated between a low of 14,770 USD/t on 3 January and a high of 16,460 USD/t on 12 March. In early April, prices dipped below 13,900 USD/t for the first time since August 2020 (13,815 USD/t on 8 April), amid heightened geopolitical uncertainty. A swift rebound followed, with prices ending April at 15,375 USD/t. This coincided with a weaker US dollar and the Indonesian government’s announcement of higher royalties on raw materials. Notably, while the LME nickel cash seller price in US dollars declined by around 3% over April, the equivalent in Euros saw a steeper decline (−8%), while the decrease in Chinese Yuan was in line with the US dollar movement.

Combined LME and Shanghai Futures Exchange (SHFE) average monthly stocks have been rising steadily since August 2023. In 2024, combined stocks more than doubled, from 83,000 t to 198,000 t. This upward trend persisted into 2025, inventories surpassed 230,000 t in March for the first time since July 2021 and totalled close to 235,000 t in April.

The composition of LME stocks by origin has shifted significantly following the recent approval of Chinese and Indonesian brands. Throughout 2024, the share of Chinese-origin nickel in LME warehouses rose from 11% to 47%, accounting for 69% of the net inflow during the year. Deliveries of Indonesian brands began in July 2024, initially comprising 1.46% (1,512 t) of total nickel stocks, and increasing to 4.68% (7,044 t) by year-end. Meanwhile, the share of Australian material dropped from 37% to 17%, and Russian material from 30% to 19%. However, in absolute terms, volumes remained relatively stable. Australian stocks rose slightly from 25,000 t to 26,000 t, while Russian stocks increased from 24,000 t to 29,000 t. By the end of March 2025, Chinese-origin material had strengthened its dominant position, making up 51% of total LME nickel stocks (96,918 t). Russia followed with 21% (40,554 t), and Australia with 13% (24,552 t). Indonesia maintained a steady share of just under 5% from January to March, reaching 8,928 t in March.

LME end-of-month off-warrant stocks amounted to 82,338 t at the end of April, the highest level recorded since reporting began in February 2020.

About this Featured Story

Appearing in the June 2025 issue of Stainless Steel World Magazine, this Featured Story is just one of many insightful articles we publish. Subscribe today to receive 10 issues a year, available monthly in print and digital formats. – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.