Government and industry representatives met on the 24th and 25th April 2023 for the most recent International Nickel Study Group meetings during which the Group reviewed its forecasts for nickel production and use in 2023. This article gives a brief overview of recent developments and is based on the data finalized at the meetings.

By Ricardo Ferreira, INSG Director of Market Research and Statistics, and Francisco Pinto, INSG Manager of Statistical Analysis

The global economy has been gradually recovering from the impact of the COVID-19 pandemic and starting to overcome some of the effects of the ongoing conflict in Ukraine. China reopened its economy which is rebounding. Energy constraints are receding, and most central banks have been raising interest rates to control inflation, although this has also resulted in some side effects in the financial sector. Overall, projections for world growth in 2023 are lower than those in 2022.

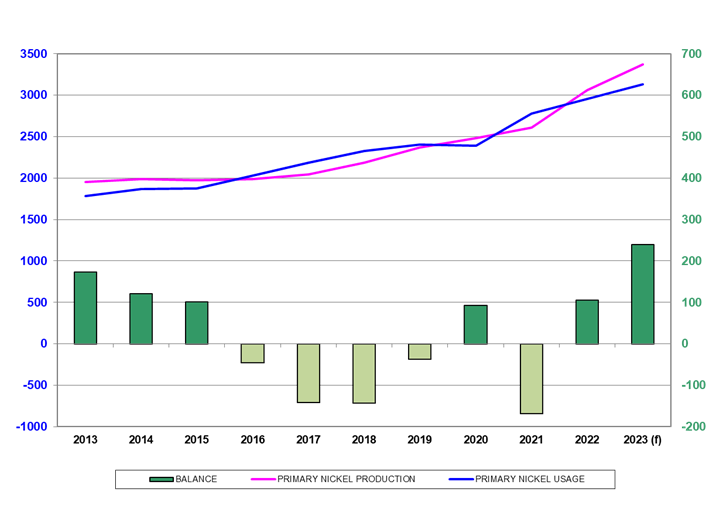

During its April 2023 meetings, the INSG revised its forecast for the nickel market balance in 2022 to a surplus of 105 thousand tonnes (kt). Primary nickel production in 2022 reached 3.060 million tonnes (Mt) while usage is forecast at 2.955Mt. Preliminary figures for 2023 indicate a surplus of 239kt with production forecast to rise to 3.374Mt and use to reach 3.134Mt. Historically, market surpluses have been linked to LME deliverable/class I nickel, but in 2023, the surplus will be mainly due to class II and nickel chemicals (principally nickel sulphate).

Primary nickel production

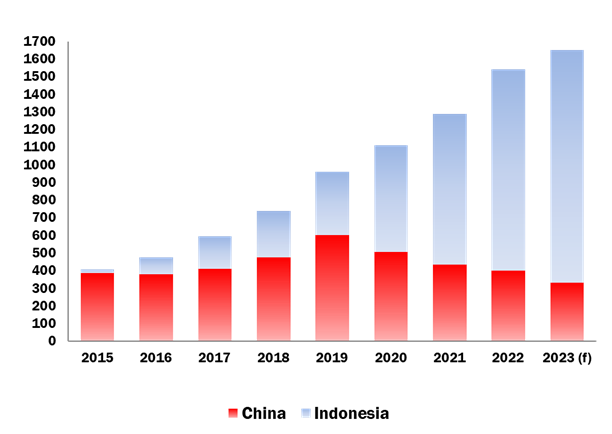

In 2023, world primary nickel production is forecast to rise by +10.2%, after increasing +5.1% in 2021 and +17.3% in 2022. Increases in output have been influenced mainly by Indonesia. However, China will again expand production, after decreases in 2020 and 2021, especially nickel sulphate. Asian primary nickel production was 2.216Mt in 2022 (+23%) and is forecast to reach 2.558Mt in 2023 (+15%), with Indonesia raising output to 1.165Mt and 1.370Mt, consolidating its position as world leader, followed by China with 850kt and 970kt, respectively.

Combined Indonesian and Chinese nickel pig iron (NPI) production was more than 1.5Mt in 2022, and is projected to increase by +7% in 2023. Indonesia has ramped up NPI production over the last decade with China ’s output starting to decline in 2019. According to Antaike, Indonesia commissioned 70 NPI lines in 2022, taking the overall total to 204. NPI accounted for more than 50% of global primary nickel production last year, but this share is likely to decline due to the increasing production of nickel sulphate.

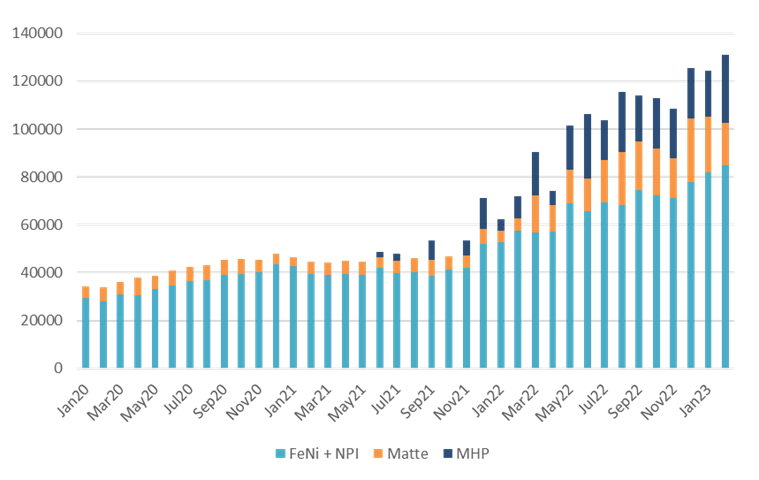

Also in Indonesia, the conversion of NPI to nickel matte is growing, high pressure acid leaching (HPAL) plants to produce mixed hydroxide precipitate (MHP) are continuing to ramp up output, and the first nickel sulphate project was commissioned in March by Lygend/Liqin. Most MHP and converted nickel matte will be exported to China to be further processed.

Estimated combined Indonesian exports of FeNi and NPI (excluding NPI in stainless steel), nickel matte and MHP (in nickel content) surged in 2022, with an increase of more than +200%. In January and February 2023, exports grew by a further +340%, compared with the same months in 2022. In Africa, primary nickel production rose +9.6% in 2022 and is expected to further increase by +2.4% in 2023.

The Americas had growth of +8% of primary nickel production in 2022 but are forecast to have negative growth of -10% in 2023. Despite the recovery in both the Russian Federation and Finland, production growth in Europe was flat in 2022, due to all four ferronickel producers having stopped production as a response to high energy prices and lower demand from stainless steel mills. However, since the beginning of April 2023, output has resumed at the North Macedonian smelter. In 2023, production is likely to decrease in the region by -3%, mainly because of anticipated lower output from the Russian Federation.

However, this will be partially compensated for by the ramp up of Terrafame’s Battery Chemicals plant, commissioned in June 2021, which will produce nickel sulphate for electric vehicles (EV) batteries. In Oceania, primary nickel production recovered in 2022, with an increase of +4.6%, and is forecast to rise by a further +7.3% in 2023 with growth in both Australia and New Caledonia (France).

Primary nickel usage

World nickel usage has grown steadily since 2009, with the only exception being in 2020, when it declined by -0.6%. In 2022, usage rose by +6.3%and is forecast to increase by a further+6.1% in 2023, to reach 2.955Mt and 3.134Mt, respectively. All world regions except Europe experienced growth in 2022, and only Africa is expected to reduce usage in 2023.

China will have the biggest increase in absolute volume. In 2022, Asia accounted for 84.9% of global primary nickel usage, reinforcing its dominant position (as a reference, Asia’s share in 2010 was ‘only’ 63%). Further growth of +6.7% is anticipated in the region in 2023, reaching a share of 85.4%.

Demand in China, which used 59.2% of the world’s primary nickel in 2022, is forecast to increase by almost +10% in 2023, driven by the battery sector in both years and by the stainless steel (STS) sector in 2023. After starting production of STS in 2017, Indonesia became the second most important nickel user in 2020 (with usage reaching 210kt, surpassing that of Japan) and achieved 370kt in 2022. However, usage is projected to remain stable in 2023.

As anticipated, nickel usage in Europe declined by almost -5% in 2022, but is expected to recover by +3% in 2023. Similarly, in the Americas, usage decreased by around -1% in 2022, and is projected to expand by +3% in 2023. The trend in Africa was in the opposite direction, with a recovery of almost 5% in 2022, but a forecast decline of -28% in 2023. The STS sector remains the most important first-use market for nickel, although its share has been slowly declining since it peaked in 2020.

This is because of the growing electrification of vehicles. In 2022, stainless steel accounted for almost 69% of world primary nickel usage (not counting scrap) with this share projected to decline to around 66% in 2023. Higher demand for nickel in order to produce lithium-ion batteries will lead to a bigger proportion of the market accounted for by this sector over the coming years.

The World Stainless Association (former International Stainless Steel Forum/ISSF) released figures for the full year of 2022 showing that “stainless steel melt shop production decreased by 5.2% year-on-year to 55.3 million metric tons,” after decreasing -2.5% in 2020 and increasing +14.5% in 2021. Preliminary forecast figures for world stainless steel consumption (subject to revisions) indicate an increase of less than +2% in 2023. This figure confirms that demand growth from the stainless steel sector is expected to be moderately positive in 2023, in line with lower economic expectations for the year.

As reported by the consultant “EV Volumes”, world sales of EVs reached 10.5 million in 2022 (+55% growth), after increasing +43% in 2020 and +109% in 2021. EV sales represented 13% of global light vehicle sales in 2022, while in 2020, the share was 4.2%, and in 2021 8.3%. EV sales show that “PHEVs [plug-in hybrid electric vehicles] stood for 27% of global plug-in [PHEV + battery EV, or BEV] sales in 2022 compared to 29% in 2021.

While their sales volumes still increased, their share in the PEV mix is in decline, facing headwinds from incentive cuts and improving BEV offers.” Sales in Europe increased +15%, in USA and Canada by + 48% and in China by +82%, continuing to indicate a shift to China. For the full year of 2023, EV Volumes “expect sales of 14,3 million EVs, a growth of 36% over 2022, with BEVs reaching 11 million units and PHEVs 3,3 million units.”

In China, annual production of ternary precursors used to produce different types of nickel-containing batteries has been consistently rising, from 320kt in 2020 to 633kt in 2021 and 842kt in 2022, according to MySteel. High-nickel NCM811 and NCM622 precursors gained market share last year, representing 42% (21% in 2020 and 29% in 2021) and 28% (18% in 2020 and 27% in 2021), respectively. In the first quarter of 2023, production decreased -4.4% y-o-y, reflecting lower demand, mainly due to subsidy cuts and the peak of the pandemic in the country.

Nickel prices and stocks

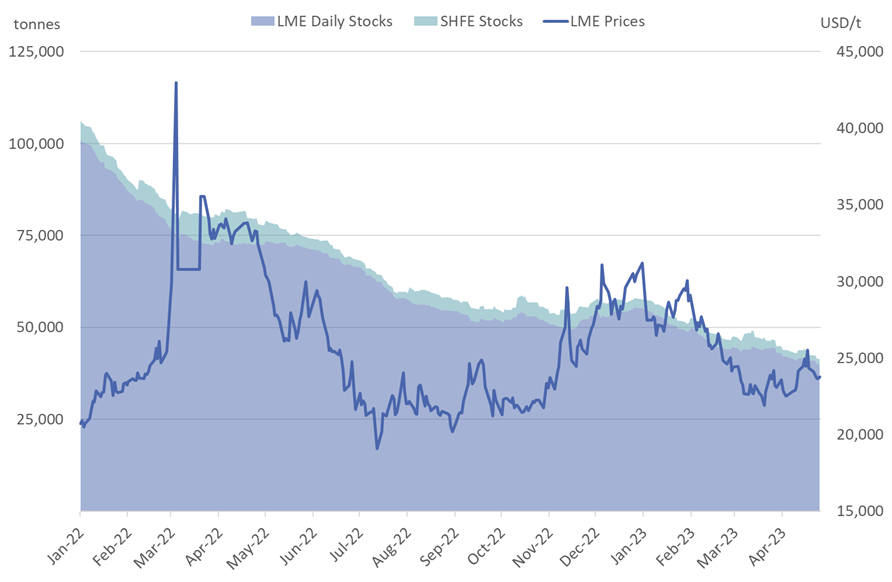

Lastly, we will briefly analyse trends in nickel prices and exchange stocks over 2022 and the beginning of 2023. In 2022, the London Metal Exchange (LME) nickel price (close, cash settlement) rose 47.2% from 20,750 USD/t to 30,550 USD/t. The March 2022 disruption event preceded a volatile year. After a few days during which trading was suspended, on 25 March, the LME published an official (close) cash price of 35,550 USD/t.

After that, prices bottomed out at 19,100 USD/t on July 15, oscillated between 20,000-25,000 USD/t until mid-November 2022, and then trended upwards to peak at 31,200 USD/t on 3 January 2023. This year, prices moved downwards to 21,895 USD/t by mid-March, followed by a slight recovery, closing at 23,770 USD/t at the end of April.

Average monthly prices reflect the recovery in the third quarter of 2022 and a slower first quarter of 2023. After a low in July (21,483 USD/t), average prices surpassed 25,000 USD/t in November and reached 28,854 USD/t in December. In the first quarter of 2023 prices then dropped to a monthly average of 23,307 USD/t in March.

This coincided with news of new class I nickel capacity by Chinese producers, the end of subsidies for EVs in China, reports of slower stainless steel demand, a stronger dollar/RMB exchange rate and economic uncertainty. In April, prices slightly recovered to 23,757 USD/t. Additionally, some analysts commented that there had been a growing divide between LME deliverable class I and class II nickel prices since 2022.

LME nickel volumes have dropped since March 2022. From January 2021 to February 2022, the monthly average of lots traded per day was between 60,000 and 90,000. Since April 2022, averages ranged between 34,700 and 47,800. In March 2023, 37,540 lots were traded per day on average in the LME. Some analysts argued that the less liquid market is linked to the higher volatility in prices.

Between April 2021 and the third quarter of 2022, combined LME and Shanghai Futures Exchange (SHFE) nickel stocks decreased from approximately 270,000t to 55,080t. Destocking was slower

in 2022 than in 2021, and combined exchange stocks increased slightly in the fourth quarter of 2022 (when a total of about 2,800t were added).

Since the beginning of 2023, the destocking trend has recommenced and exchange stocks decreased at an average pace of about 4,000t per month, ending April at 41,440t. LME nickel stocks reached a historic low of 39,918t on 27 April – the first time LME stocks had fallen below the 40,000t mark since 2007. LME end-of-month off-warrant stocks in February 2023 were 3,619t.

This is in line with the reported figures since 2021Q3 (hovering between 2,000t and 7,000t), after declining in 2021Q2 from levels above 20,000t, that were the norm since the LME first started disclosing this figure in February 2020.

About this Featured Story

This Featured Story appeared in Stainless Steel World June 2023 magazine. To read many more articles like these on an (almost) monthly basis, subscribe to our magazine (available in print and digital format – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.