As the fifth most commonly found element on earth, nickel ores are mined in about 33 countries and are smelted or refined in about 30 countries. Nickel is used in over 300,000 products in the form of over 3000 alloys. It is an indispensable material for use in construction, automobiles, the petroleum and chemical sector, fabrication and welding, power and renewable energy, electronics and transportation.

By Jianbin Meng, Director of Economics and Environment, International Nickel Study Group (INSG)

The stainless steel industry uses about 70% of primary nickel, the battery industry uses around 12%, with the remaining primary nickel going to foundry, plating and other alloy industries.

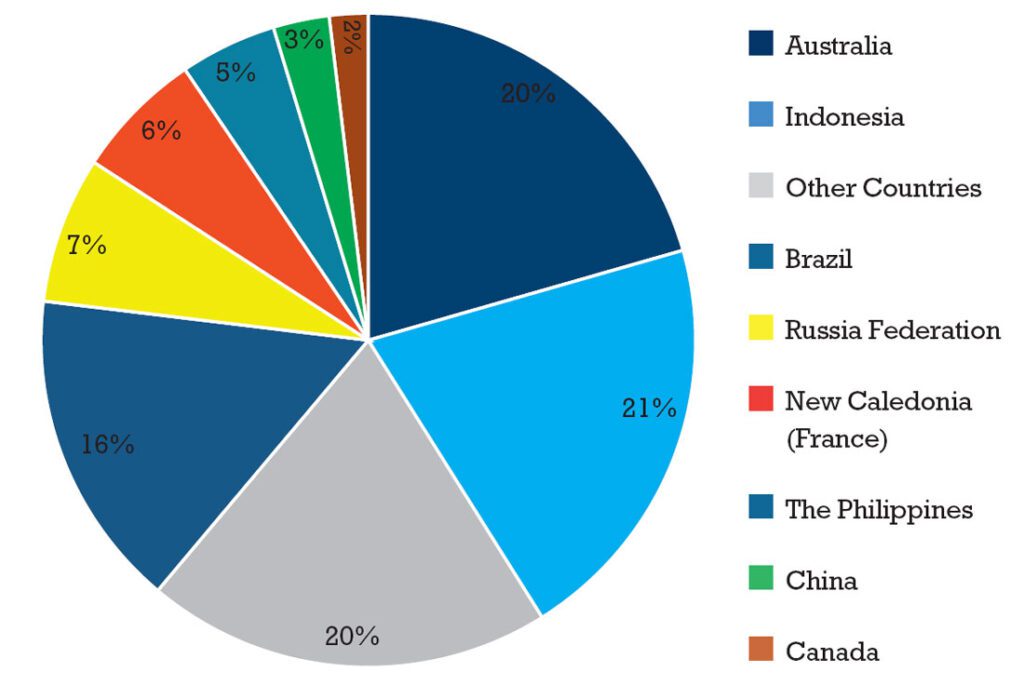

Major nickel mining countries

Indonesia, the Philippines, New Caledonia (France), Russia, Australia, Canada, and China are the major nickel mining countries. Their combined nickel minerals output (nickel content) reached 2.18 million tonnes in 2021, accounting for more than 80% of the world’s total nickel mine production of around 2.7 million tonnes.

Globally reported mineral reserves are between 90-100 million tonnes, mainly distributed in Australia, Indonesia, Russia, New Caledonia (France), the Philippines, China, and Canada.

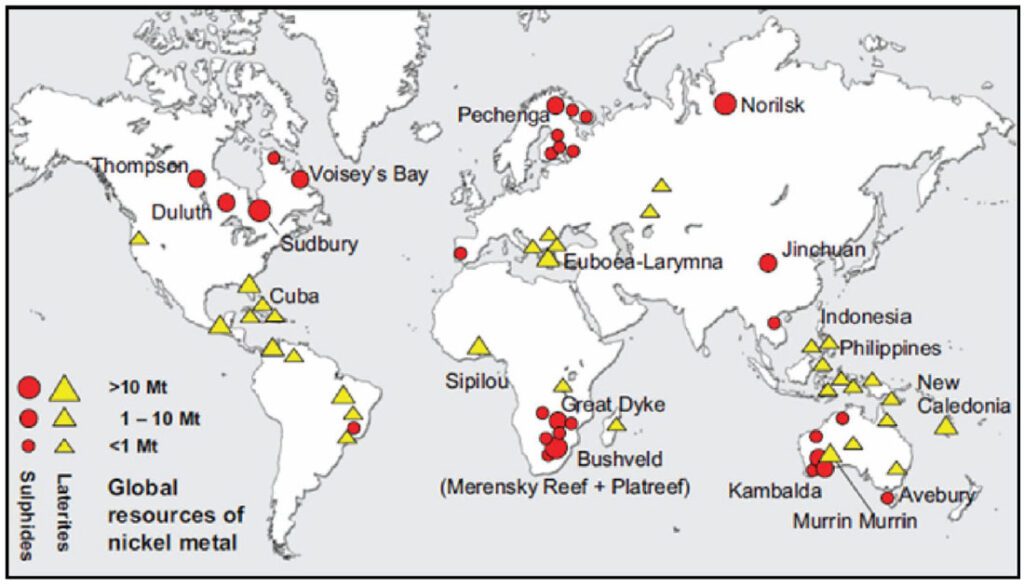

It is estimated that around 65% of the worldwide nickel deposits are laterite; the remaining 35% are sulphide. As shown in Figure 2, most of the nickel laterite deposits are scattered around the equator where warm and tropical weather dominates, encouraging the necessary chemical and physiochemical reactions. However, nickel laterite resources also occur in Oregon (US), Russia and Canada which are far from the equator.

Australia, with estimated nickel reserves above 21 million tons, is at the top of the list. At the rate of production achieved in 2021, its deposits are sufficient for about 137 years. Based on the JORC-compliant standard, the reserve estimation in Australia comes down to 8.3 million tonnes which could be mined for 54 years at the current rate. According to Geoscience Australia, nickel resources are found mainly in Western Australia within komatiitic volcanic-hosted nickel-copper-platinum group element (Ni-Cu-PGE) sulphide deposits, lateritic nickel deposits and, to a lesser extent, Ni-Cu-PGE sulphide and hydrothermal deposits hosted within tholeiitic intrusion. Data released by the Australian Bureau of Statistics shows that, in 2020, the overall exploration expenditure for nickel and cobalt was AUS 181.4 million, down by 21% from the AUS 229.7 million witnessed in 2019.

Indonesia holds a large reserve of about 20 million tons of laterite ore. The Ministry of Energy and Mineral Resources (ESDM) published information showing that Indonesia’s nickel resources in 2016 were 3.2 billion tonnes. However, significant investment in exploration is required to convert these resources into mineable reserves. The rapid expansion of the Indonesian nickel mining industry can be mainly attributed to the increased demand for nickel pig iron (NPI) for stainless steel production. Indonesia, thanks to its rich nickel resources and competitive energy costs, is very attractive to companies engaged in the production of NPI and stainless steel. In 2021, Indonesia mined 1.04 million tonnes of nickel (metal content) to become the largest nickel ore producer in the world. At a meeting in November 2021, the Minister of Energy and Mineral Resources (EMR), Arifin Tasrif, reported that there were 13 nickel smelters in operation, and the government planned to construct an additional 17 smelters by 2023 by investing USD8 billion.

Brazil’s Ministry of Mines and Energy updated its nickel reserve estimates to 16 million tonnes according to data listed in its Mineral Sector Bulletin 2021 published in March 2022. According to the same bulletin, Brazil’s nickel reserves accounted for 17% of the world total. The State of Goiás holds more than 70% of these reserves. In 2020, Brazil mined only 77,100 tonnes of nickel in terms of metal content. However, the Brazilian government is proactively promoting the development of the minerals sector. In October 2021, a collaborative network for mining financing in Brazil, Invest Mining, was set up to facilitate the funding for project development.

Russia’s nickel reserves stand at around 7.7 million tonnes. The main composite of Russia nickel ore is sulphide which is a key raw material regarding the production of high-grade nickel and cathode materials. Nornickel controls the largest nickel mine at Norilsk and currently produces about 17% of high-grade nickel globally. By the end of 2021, Nornickel’s combined nickel resource base stood at 27,951 thousand tonnes (contained nickel), while in 2020 and 2021, it produced 233 thousand tonnes and 199 thousand tonnes of refined nickel respectively. Based on the 2020 production rate its current resource could sustain output for another 120 years. The Amur Oblast region of the Russian Far East hosts a huge potential in nickel resources with the Kun-Manie Nickel – Copper Sulphide project at the most advanced stage. According to its TEO (a Russian feasibility level study) approved by the Russian Federation State Committee on Reserves (“GKZ”), the project is expected to produce 627 thousand tonnes of nickel contained in concentrate during its 19 years of life of mine. Russia’s Far East Development Agenda has been developed to attract further investment into the region and more projects can therefore be expected to be brought online in the future.

New Caledonia (France) comes next with reserves of 6.6 million tonnes. The main mineral types include laterite (saprolite, limonite) and garnierite. Goro Plateau is the most important area as it hosts a nickel deposit with total proven and inferred resources estimated at about 124 million tonnes of high-grade laterite ore with a nickel content of around 1.4%. There are 7 miners in New Caledonia with either active mining activities or assets under maintenance. In 2021, New Caledonia became the third largest nickel mining jurisdiction in the world with a production of 186 thousand tonnes of contained nickel. The Directorate of Industry, Mines and Energy of New Caledonia (DIMENC) is responsible for the territory’s mining and metallurgical industry. It promotes, organizes and coordinates the development of mineral resources while guaranteeing a harmonious integration of extractive activity into its social and economic development.

In recent years the nickel mining industry in the Philippines has expanded rapidly thanks to the increase in Chinese NPI production and Indonesia’s ban on exports of untreated ore. In 2021, nickel mine production in the Philippines reached 393.7 thousand tonnes (metal content), second only to Indonesia. The main type of nickel deposit in the Philippines is laterite which is distributed across the archipelago with the major mines located on the resource-rich island of Mindanao. According to the Mineral Accounts of the Philippines published by the Philippine Statistics Authority (PSA) in 2020, the total nickel reserves in the Philippines increased by 1.5 %, from 2.02 billion tonnes in 2013 to 2.05 billion tonnes in 2018. Among the three classes, Class A (commercially recoverable resources) was largest in 2013, while Class C (Non-commercial and other known deposits) consistently having the highest share from 2014 to 2018, comprising of 49 to 54 % of the total reserves. Class A nickel reserves decreased by more than 84 million MT or around 8% of the 1.03 billion tonnes of reserves during the period 2013 – 2018. Although the stock of Class A nickel showed a steady decreasefrom 2013 to 2017, a large increase

was recorded in 2018 due to upward reappraisals amounting to more than 119 million tonnes. Meanwhile, Class B (potentially commercially recoverable resources) nickel reserves hugely declined from 108.8 million tonnes in 2013 to 28.4 million tonnes in 2016 and down to zero in 2017 and 2018 due to reclassifications. Lastly, due to the entrance of new players, reclassifications and reappraisals, Class C nickel reserves increased from 880 million tonnes of reserves in 2013 to 1.1 billion tonnes in 2018.

China’s nickel reserves of 2.8 million tonnes in 2021, as estimated by the US Geological Survey (USGS), account for only 2-3% of the global total. However, the same figure estimated in an official report by the China Geological Survey for 2020 was 3.98 million tonnes, accounting for about 4.4% of the world reserves. Nickel sulphide is the dominant ore type and accounts for over 90% of China’s total reserves, the remaining 10% of the reserves are laterite. Despite a dearth of nickel resources, China’s nickel mine production reached 104.6 thousand tonnes in 2021 and ranked as the 7th largest nickel mine producing country. In terms of primary nickel production, China’s 685 thousand tonnes were second only to Indonesia’s 879 thousand tonnes. China’s primary nickel production has been decreasing over the past three years in contrast to the continuous production growth in Indonesia as a result of restraints put on ore export by the latter and capacity reallocation to Indonesia by Chinese NPI and stainless steel producers.

Canada has a long history of nickel mining, with its reserves estimated at 2 million tonnes by the USGS in 2022. It mined 116.3 thousand tonnes of nickel and ranked 6th place in the world in 2021 despite a decline in output for three years in succession. Nickel sulphide ores are found at Sudbury, Ontario and Manitoba. British Columbia is also a promising nickel-rich province with some exploration projects underway.

The United States reported a reserve of 340 thousand tonnes in 2022 for three projects, and there are additional three domestic projects which have defined resources but have not yet defined reserves. With nickel added to US Critical Minerals List, more exploration activities are expected to take place in the US, and its reserve base of nickel could increase along with the exploration activities.

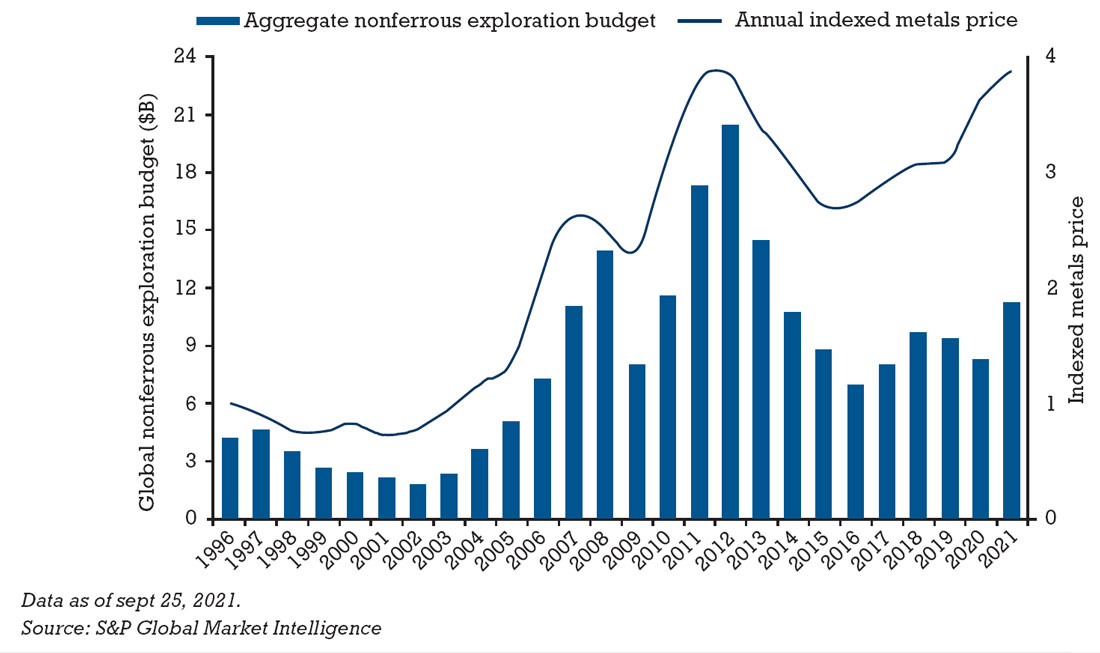

Unreported reserves and reserves by the rest of the world are estimated at around 21 million tonnes. One important factor affecting the nickel ore reserves is that less and less expenditure was earmarked for geological exploration due to stagnant commodity prices after the 2008 financial crisis. As shown in Figure 3 published by S&P Global Market Intelligence, exploration budgets are positively correlated with commodity prices. With prices picking up and improved economic sentiment, more reserves are expected to be defined in the coming years. It should also be noted that in a number of countries, accurate reserve figures are not available.

Conclusions

The accelerating electrification of the global vehicle fleet combined with the rapid growth of the renewable energy generation and storage sectors are expected to result in a surge in demand for nickel over the next few years. There are extensive nickel resources and reserves located in many countries around the word. However, on average the development of a new nickel mine can take between 7-10 years or more to ramp up. In addition, increasing concerns related to ESG issues may add further complexity to the permitting process in some cases.

On the positive side, as nickel’s importance in the production of batteries for EVs, green energy in general and in meeting climate targets is being increasingly widely recognized by governments, academia, financial and investment institutions, and the corporate world. This is encouraging capital inflows into nickel exploration and processing. As a consequence, it is anticipated that the rate of identification and demarcation of further nickel resources and reserves should accelerate in future.

About this Featured Story

This Featured Story appeared in Stainless Steel World October 2022 magazine. To read many more articles like these on an (almost) monthly basis, subscribe to our magazine (available in print and digital format – SUBSCRIPTIONS TO OUR DIGITAL VERSION ARE NOW FREE) .

Want to contribute as author? Please contact Joanne.

Every week we share a new Featured Story with our Stainless Steel community. Join us and let’s share your Featured Story on Stainless Steel World online and in print.